This week’s newsletter features three important “hot button” topics: the state’s outdated tax structure, minimum wage, and carbon pricing. Washington ranks 35th in the country in the combined total of state and local taxes paid and has the most regressive state tax system in the nation. I hope you will take a few minutes and watch Representative Reuven Carlyle’s video explanation of Washington taxes. Rep. Carlyle chairs the House Finance Committee and is one of the state’s leading experts on revenue and taxes. I hope you find the information on these three topics helpful and informative.

On Presidents’ Day the House traditionally has “Children’s Day” when we bring children and grandchildren onto the House floor so we can honor them and spend a few extra minutes with them. I could not resist sharing a photo of me and my grandson, Rory, on his first visit to the floor.

Check out the House Democrats Facebook page for more photos from Children’s Day 2015!

Outdated and Unfair — Talking Taxes in Washington

USA Today recently reported that Washington had “by far the most regressive tax system nationwide.” In the video above, my colleague, Rep. Reuven Carlyle, outlines Washington’s broken and regressive tax structure, and explains how Washington’s high reliance on a sales tax has placed an unfair tax burden on its poorest citizens. Our system isn’t working, and it’s unfair to the middle class. According to the data in the USA Today story, the poorest 20% of Washington families pay nearly 17% of their income in state and local taxes, while the wealthiest 1% in Washington pay just 2.4% — “one of the highest such ratios nationwide.”

Watch the video here and read more on The Advance.

The middle-class crunch in Washington state

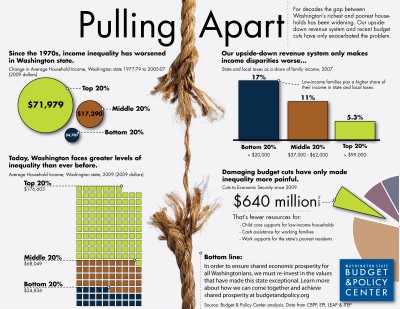

These two infographics help explain the middle-class crunch in Washington state.

The first, by the Budget and Policy Center, shows how the benefits of the booming economy have mostly gone to the wealthiest, while years of massive budget cuts have hammered middle-class families.

The second infographic exposes common myths about the minimum wage as the House and Senate debate raising it in Washington to $12 an hour over the next few years. The House is debating several proposals that would raise the minimum wage over the next few years to make up for some of the ground lost for low-income wage earners.

Conventional wisdom holds that people earning the minimum wage are high school or college students, and that it’s mostly spending money. The truth is different.

Carbon Pricing

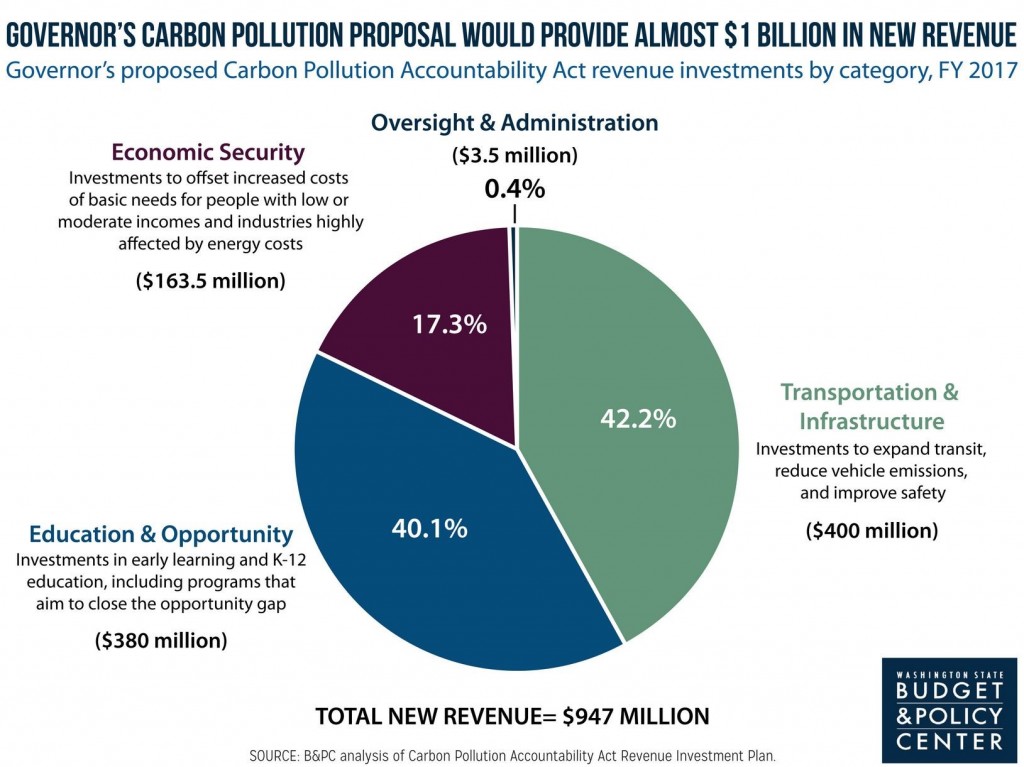

Governor Inslee recently unveiled a plan to move Washington toward cleaner, renewable energy sources. The Washington Carbon Pollution Accountability Act is a key piece of the puzzle in the fight against climate change. The central idea is to use a market-based approach to reduce carbon pollution and meet our greenhouse gas emission reduction targets.

Enacting a carbon pollution plan is not only good for the environment, but it also produces positive results for the state budget. An analysis from the Washington Budget & Policy Center shows Governor Inslee’s proposal could bring in an additional $1 billion in state revenues. With a multi-billion dollar budget deficit, we must have new, effective, and reliable sources of revenue to meet the needs of our state. Taxing carbon polluters could be one of those options.

What do you think?