Great news! For the first time since 2000, across the U.S., poverty is down.

Bad news. Last year, Washington was one of only two states where both poverty and income inequality went up.

Why? Well, it’s a complicated problem. But one big part of it might be our tax structure.

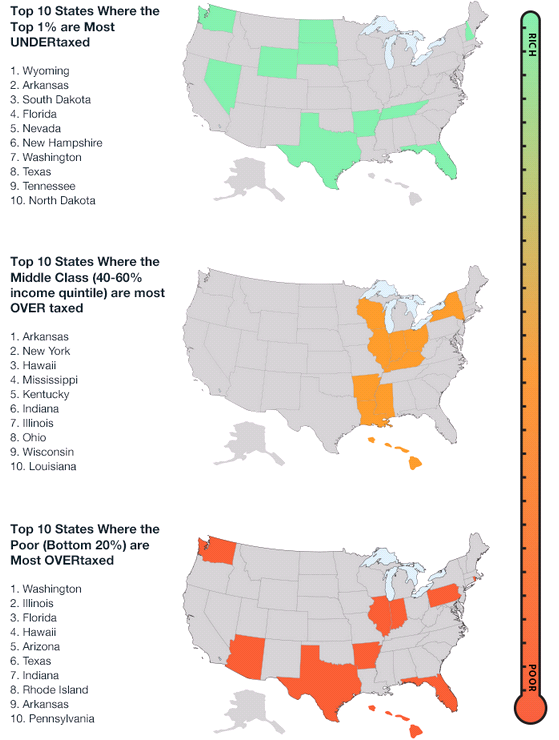

As we talked about last week, Washington has the most regressive tax system in the country. We rely very heavily on the sales tax. Everyone, no matter what their income, has to pay the same price for goods. This may sound fair, but in reality it places a much greater burden on families living in poverty.

Think about it, average state & local tax burden for families in Washington is $4,366. If your family makes $100,000/year, $4,366 is completely manageable. But for the 14% of Washington families living on less than $23,850/year this can be the difference between feeding their children a nutritious dinner, or sending them to bed hungry.

Not only is the sales tax unfair, it’s also unstable.

In Washington, revenue coming in has not kept up with the increased population and demand for services. We have underfunded schools, crumbling roads, prisons filled to capacity, and a mental health system that has been found to not treat patients humanely.

Our current system isn’t working. Is it time for a tax system that is more equitable and stable? A system where everyone pays their fair share?

Studies show that all Americans, Democrats and Republicans alike, are in favor of a fairer tax system. So what is fair? The Institute for Taxation and Economic Policy’s guide to fair state and local taxes says, “a fair tax system asks citizens to contribute to the cost of government services based on their ability to pay.” This means a tax system that reflects the challenges of families living in poverty and doesn’t ask them to contribute a higher percentage of their income than their middle and upper income neighbors.