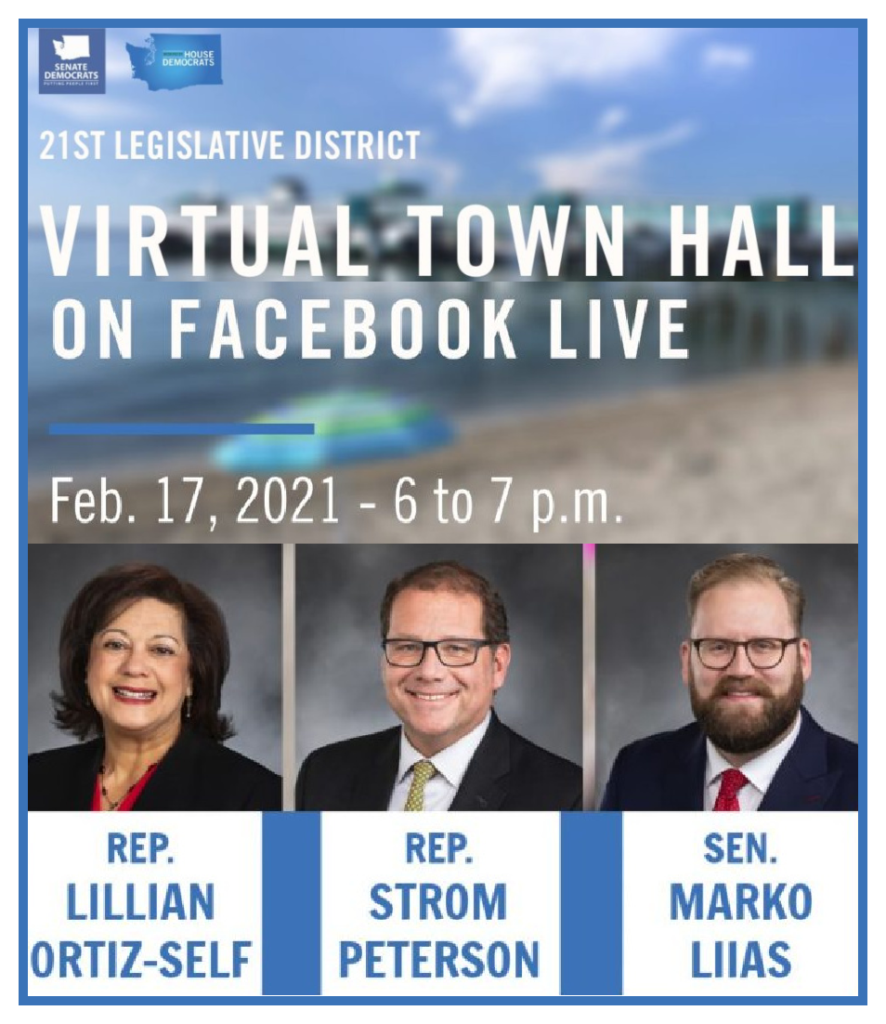

I’d like to take this opportunity to remind you that your 21st Legislative District delegation is holding a virtual town hall Tomorrow, Wednesday, February 17 at 6 p.m.

I’d like to take this opportunity to remind you that your 21st Legislative District delegation is holding a virtual town hall Tomorrow, Wednesday, February 17 at 6 p.m.

You’ll find all the details in this media advisory or on the Facebook event page and you can also watch this short video on how to participate and submit questions.

If you don’t have a Facebook account, you can still watch it on the Facebook platform.

Also, we’ll have a special guest! Rep. Pramila Jayapal will join us to provide an update on federal issues.

So be sure to join us tomorrow evening!

Can billionaire$ afford to contribute more?

We really need to get serious about addressing the fundamental and systemic problem of our state’s inequitable tax structure. People like you and me pay for schools, public health, housing and homelessness programs, public safety, and other vital government functions while the wealthiest Washingtonians pay far less than they should.

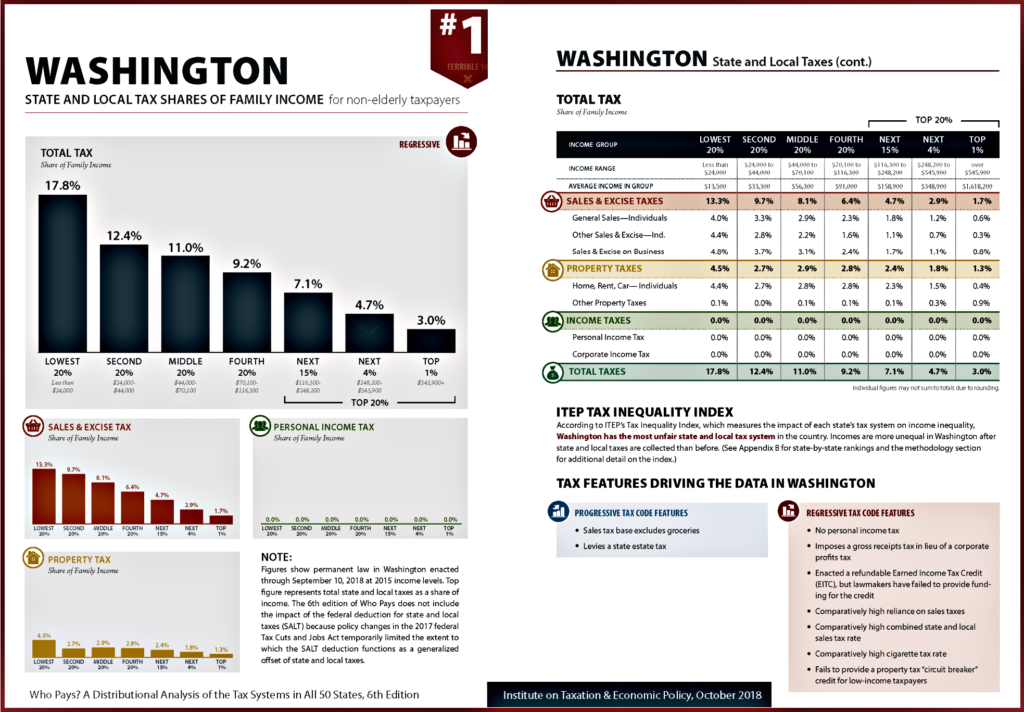

In fact, middle-class Washington families pay a larger share of our income (four times more, see charts below) in taxes than the highest-income households do. This matters because we – rather than the wealthiest among us – are the ones expected to pay for schools, safety programs, and homelessness services. For the lowest-income households – those making $24,000 or less per year, it is even worse, as they pay six times more in taxes as a share of their income.

In fact, middle-class Washington families pay a larger share of our income (four times more, see charts below) in taxes than the highest-income households do. This matters because we – rather than the wealthiest among us – are the ones expected to pay for schools, safety programs, and homelessness services. For the lowest-income households – those making $24,000 or less per year, it is even worse, as they pay six times more in taxes as a share of their income.

A bill currently under debate could make things a little better for Washington’s working families. Instead of continuing to rely on sales tax and tax on real property for the majority of our state’s revenue, a wealth tax could be a new tool in the tool box that taxes the financial assets billionaires use to make their fortunes at one percent and exempts the first $1 billion of wealth, making the tax barely a blip on the radar for someone who makes billions or hundreds of millions in a single year. If your net worth doesn’t add up to more than a billion dollars, you won’t be paying this tax. I know I won’t ever in my lifetime.

If we don’t pass this wealth tax, our state will continue to over-rely on low- and middle-income families to pay for the vital government programs and functions our communities need. Washington’s wealthiest residents can and should share more equitably in the responsibility of funding these key community programs alongside their neighbors.

If we are ever going to invest in better schools, get struggling families into stable housing, and reduce our reliance on working families to pay for it all, we must start asking the wealthy to contribute like the rest of us do.

Most Regressive Tax System in the Nation

Our state’s tax code is the most regressive in the entire country. This means that the imbalance in overall tax rates faced by low-income families versus high-income is larger in Washington than in any other state. These charts borrowed from the “Who Pays? 2018 Report” by the Institute of Taxation & Economic Policy) show the striking imbalance.

For a larger PDF version, please click on the image below.

Funding Childcare with a Capital Gains Tax

The COVID-19 pandemic has highlighted the critical importance of childcare for working families and the business community.

The COVID-19 pandemic has highlighted the critical importance of childcare for working families and the business community.

House Bill 1496 will bolster economic recovery and the economic well-being of working families by funding the expansion and affordability of childcare through a capital gains tax.

The proposal will also help address the systemic inequities in our state tax code. Washington state has the most regressive tax code in the nation (see charts above).

Working families are funding a disproportionate share of schools, public health, public safety, and other vital government functions while the wealthy pay proportionately less. Passing a capital gains tax would help ensure the wealthiest Washingtonians share in the responsibility of funding key programs and services our communities need, such as the much-needed investment in childcare.

By enacting this tax, we’ll kickstart our economy, provide resources to invest back into our communities, help rebalance our upside-down tax code, and give kids across our state a fair start.

Additional details, including tax rates and exemptions, are available in this recent press release.

Cutoffs & Update on My Bills

There are two very important dates in the legislative process: Policy and Fiscal cutoffs. Yesterday at 5 p.m. was the deadline for policy bills to pass out of policy committees. Bills that did not make it will get put on a figurative shelf until next year, when they will be automatically reintroduced, giving them another chance. Fiscal cutoff is next Monday, so bills that don’t make it out of the four fiscal committees (Appropriations, Finance, Transportation and Capital Budget) will join the policy bills on the shelf. They will also have a second chance next session.

I am happy to report that all my bills are still in the game:

Three bills in Rules (just one step away from the Floor!):

- HB 1090: Bans private for-profit detention facilities in Washington state. Corporations should not be profiting from the detention of vulnerable people.

- HB 1113: Promotes consistent school attendance by providing additional supports for schools to engage students. Daily school attendance is critical in the education of our students and this bill will allow schools the flexibility to better support students struggling to attend classes.

- HB 1363: Often our teachers are the first responders to issues impacting their students. This work can take a toll on the teacher and this bill will help provide them with access to supports aimed at protecting their mental health.

Two bills passed Appropriations today:

- HB 1194: Improves parent-child visitation during child dependency proceedings to support both the child and the parents. These visits are critical in maintaining the family bonds as the issues that lead to the dependency proceedings are solved. Passed on a 31-2 vote.

- HB 1227: Keeping Families Together Act. Our child welfare system’s primary goal is the safety of the child, a secondary goal is family reunification. These reforms will help support these goals to make sure we are doing everything possible to keep a family safely together. Passed 30-3.

One bill waiting for a vote in Capital Budget:

- HB 1154: Increases access to the Building Communities Fund grants to small non-profit organizations. This bill is more important than ever, as many of our small non-profits are helping our communities through this pandemic while fighting to survive themselves.

Ask LILLIAN 2: Waiving graduation requirements & banning private detention facilities

In this second edition of Ask Lillian, I respond to constituent emails on legislation to help high school seniors graduate, and on my bill to ban private detention facilities in Washington. To read the newsletter I reference in the video, please click here.

Thank you for reading this report. If you need more information on any of the issues discussed here, or on any other legislative matter, please don’t hesitate to contact my office. And visit my Official Facebook page for frequent updates.

Sincerely,