Democrats and Republicans worked together to pass a $3.7 billion capital budget in the House of Representatives that will build schools, college and mental health facilities. If the Senate approves the construction budget, thousands of men and women in hard hats will get to work in every corner of the state.

The budget was a joint proposal by Representative Hans Dunshee and the ranking Republican on the committee. It passed the House Capital Budget Committee unanimously and passed the House on a 96-2 vote. As a member of the Capital Budget Committee, I was proud to be part of this bipartisan process.

Here are some of the highlights from our budget:

- Education: $1.6 billion on education, including $627 million on School Construction Assistance Program.

- Mental Health: $7 million, including upgrades and higher capacity at Western and Eastern State hospitals.

- Housing: $80 million to targeted Housing Trust Fund projects.

- Natural Resources: $191 million for the Water Pollution Control Program & $57 million for state parks.

To read about specific projects in our district, check out my previous newsletter here.

Funding the Operating Budget

While the capitol budget funds construction, our operating budget funds our state agencies and operations. The budget proposed by the House Democrats takes the steps necessary to move our state forward by fully funding education, repairing our broken mental health care system and restoring the Safety Net. To do this, we need to fix Washington’s broken tax system.

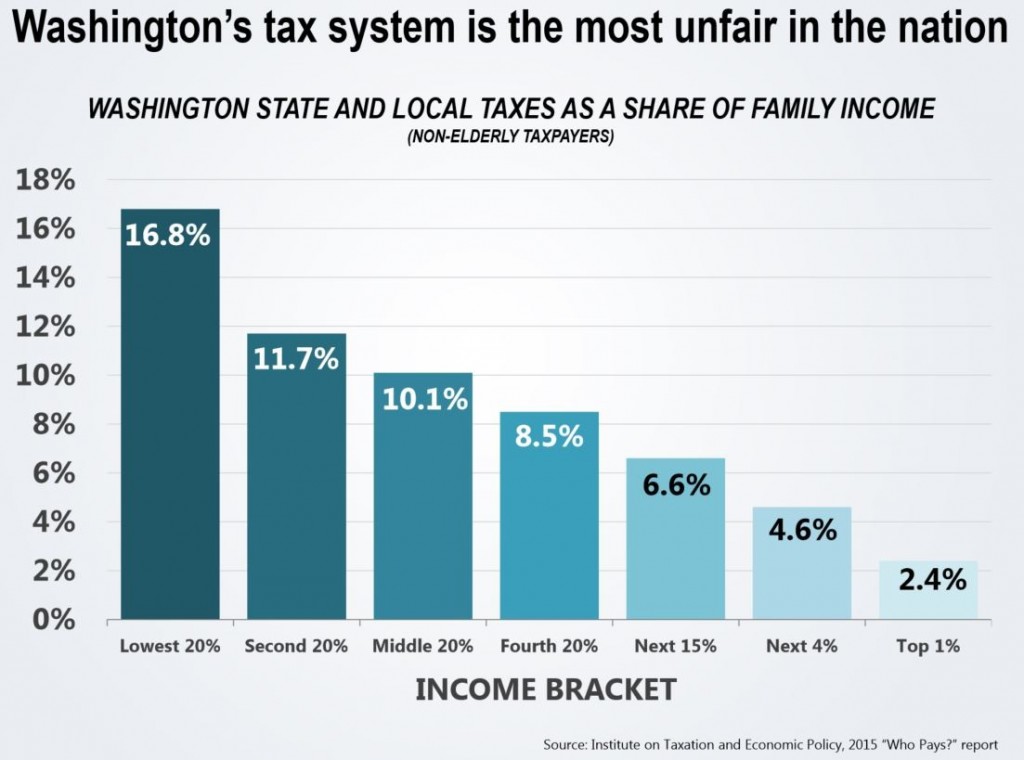

Our state has the most unfair tax system in the nation. You read that right, the most regressive of all 50 states. That means that middle-class and working families pay four to seven times more of their income in taxes than the wealthiest five percent.

Fair Share on capital gains

The House Democrats have proposed a 5% Fair Share Tax on capital gains when a person makes more than $25,000 in profit (or $50,000 for joint filers) from the sale of stocks, bonds and other lucrative investments. This proposal would almost exclusively apply to the very-wealthy in our state. In fact, according to non-partisan analysis, families with a total income less than $250,000 a year would have accounted for less than 3 percent of capital gains from 2007-2012. Instead, this fair share tax will impact only about 32,000 of Washington’s wealthiest households.

A better place to do business

We’re going to get Washington back to business by nearly doubling the small service business B&O tax credit, while asking wealthier corporations to pay more of their fair share. This proposal will mean that more than 70% of small businesses will either pay $0 or a reduced rate in business & occupation taxes. At the same time, we’re reinstating the 1.8 percent tax rate for larger service businesses, which is what the rate was before the Great Recession and almost 1 percent lower than it was two decades ago.

Under our plan, B&O taxes are eliminated for an additional 15,000 business each year. That’s a major reduction for small business owners like myself.

Closing costly tax breaks

Our state has over 650 tax breaks on the books. Some make sense, and help the people of Washington, but some no longer benefit the intended industries. Our proposal would end a few of these costly tax breaks.

- Currently, banks do not have to pay real estate excise taxes when they foreclose on a home. We change that so banks and financial institutions have to pay what you and I pay when we sell our home.

- Nonresidents currently don’t have to pay our sales tax. But if a Washingtonian works in Oregon, they have to pay Oregon income tax. Our proposal says that if you’re a nonresident and you shop in Washington stores you should pay a Washington sales tax.

- In 1949 the state created a tax exemption for extracted fuel to help the timber industry. Today, 98 percent of the cost of this tax is taken by the state’s five oil refineries. Our proposal would put them at the same tax rate as brokered natural gas.

House Democrats focus on food policy

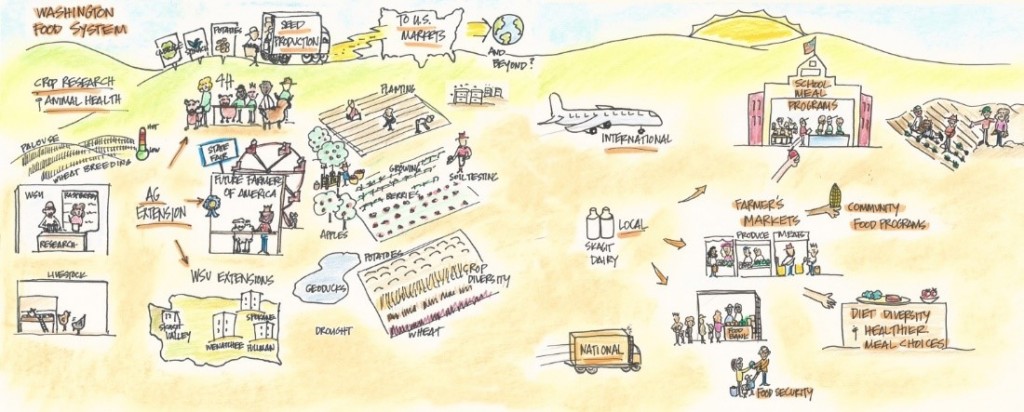

Food is an integral part of our lives. It affects how we learn, work and live. From the toddler who needs nutritious food to build strong muscles and bones, to the high-school student who can’t learn algebra on an empty stomach, to the family that gets a moment to slow down and enjoy dinner together, food should keep us healthy and happy.

If we want healthy families in Washington we must support those who provide food to our communities, at every step in the process, from production to consumption.

House Democrats are committed to creating a comprehensive food policy that works for all Washingtonians. Whether it’s rolling wheat fields in Spokane County helping to feed the world or a small urban garden in Tacoma helping to stock the local food bank we are taking steps to create a Washington food policy that works from farm to table. Just a few things we have done to date:

- Help farmers support bee pollination so their crops can thrive;

- Provide a healthy breakfast for students at school;

- Provide grants to connect growers with the most modern farming techniques;

- Fully fund food assistance and emergency food assistance so families in need can afford tomatoes instead of Top Ramen;

- Provide fee exemptions to cider producers to help them thrive;

- Boost education and jobs with $600,000 in new funding for four farming degrees at WSU-Everett in two phase: Agriculture & Food Security and Organic Agriculture, then Sustainable Food Systems and Urban Horticulture.