How can we make the middle class stronger and reduce the rising tide of inequality?

That’s a question being asked not only here in Washington state, but across America and throughout the world.

The just-ending global recession—the worst since the Great Depression—brought this issue to the forefront. While the economy is recovering in Washington state and elsewhere, most of the gains of the recovery are going to the wealthy. This article dives into how and why, and it gives a good history lesson.

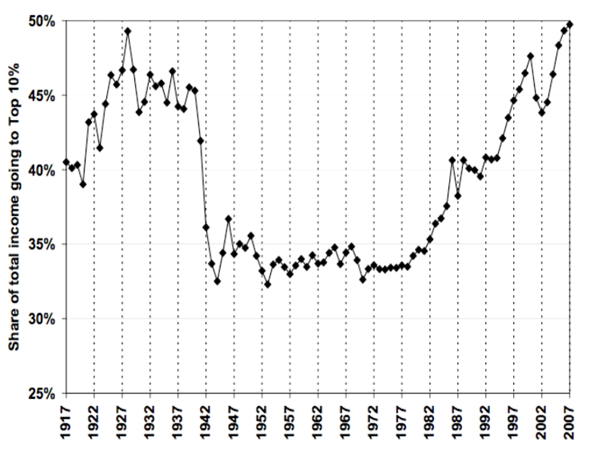

This chart provides a snapshot of where our national income is going:

Source: https://seekingalpha.com/article/157061-gap-between-rich-and-poor-growing-in-u-s

For almost 40 years, there was a remarkable period of greater equality and opportunity. From 1942 until about 1982, the share of total income going to the wealthiest 10 percent dropped down to under 35 percent and stayed there.

This is also the period where America boomed after World War II, where the building of the interstate highways, the growth of suburbia and a strong middle class all went hand-in-hand.

It’s not simply a question of fairness and opportunity for all. Economists say the Great Depression and Great Recession were both foreshadowed by a shrinking middle class and a growing chasm between the rich and poor. Here’s a key passage from the story:

Most economists say some inequality is needed to reward hard work, talent and innovation. But a wealth gap that’s too wide is usually unhealthy. It can slow economic growth, in part because richer Americans save more of their income than do others. Pay concentrated at the top is less likely to be spent.

It can also trigger reckless borrowing. Before the 2008 financial crisis, middle class households struggled to keep up their spending even as their pay stagnated. To do so, they piled up debt. Swelling debt helped inflate the housing bubble and ignite the financial crisis. Experts note that the Great Depression and the Great Recession were both preceded by surging income gaps and heedless borrowing by middle class Americans.

The story also points out that while there’s always been a gap between the rich and the poor, in previous times, everybody rose and fall at about the same rate. Today, the benefits of the economic recovery are largely going to the top 1 percent, because they own stock. Corporate profits are hitting record highs while average workers see their salaries stuck in neutral.

A Pew Research Center study found that the wealthiest 7 percent of households grew 28 percent richer from 2009 through 2011. For the bottom 93 percent, collective wealth fell 4 percent. That’s largely because wealthy households own far more stocks and other financial assets than others. By contrast, whatever wealth middle class Americans have is mainly in their home equity.

Since the Great Recession ended, stock market averages have soared, setting records in 2013. Home values, though, remain far below their peaks reached in 2006. That divergence has benefited the richest and left others struggling. … (T)he Congressional Budget Office did include government benefits and the effect of taxes in its own study and still found a sizable gap: For the top 1 percent, income jumped 275 percent, adjusted for inflation, from 1979 to 2007. For the middle 60 percent of Americans, it grew less than 40 percent.