Urban legends abound about any number of things, like the idea there is more nutritional value in the wrapper then there actually is in the Twinkie it wrapped.

While that myth is an amusing relic of our folklore, myths about taxes have real consequences that are not necessarily in the best interests of the residents of Washington State.

We continually hear the mantra that taxes are too high and that because we have $2 billion more for this budget than we did two years ago, everything will be fine. The state has plenty of money. Both these points are perfectly legitimate positions to take. However, in the debate we should at least recognize the facts surrounding the issue.

TAXES ARE TOO HIGH

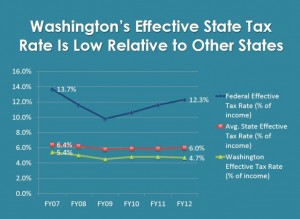

Fair point of view and the chart above shows the reality of the tax burden carried by Washington taxpayers. Even conservative think tanks that often say “taxes are too high” acknowledge Washington is a moderate to low tax state. Because Washington relies on sales tax the burden disproportionally falls on moderate to low income taxpayers rather than the wealthy.

$2 BILLION MORE IN REVENUE THIS YEAR

It is true we have $2 billion more this budget than last, seems like that should be plenty, right? Unfortunately the rhetoric around this question ignores the fact that state revenue for this budget is just now back to where it was five years ago, before the recession hit. In the meantime our population has grown substantially. We have more children in K-12, more students attending college, and more low income seniors in need of the medical care. Here is a good post that helps explain this point.

I am all for a vigorous debate about tax policy and spending priorities, let’s just be truthful and transparent about the reality of the numbers as we have that debate.