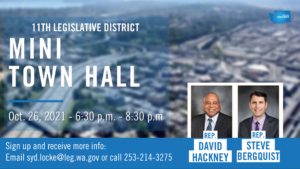

Sign up now for an Upcoming Mini Town Hall

Rep. David Hackney and I are hosting a Mini Town Hall on Tuesday, October 26 from 6:30-8:30 p.m. Rather than in-person chats, each participant will sign up for a 15-minute time slot in which they’ll have a personal call with us via Zoom or over the phone.

How to sign up: Please email my legislative aide, Syd Locke, at syd.locke@leg.wa.gov or call the office at 253-214-3275.

If you have things to say but can’t participate in the Mini Town Hall, please feel free to email me at steve.bergquist@leg.wa.gov. I try to respond to every call, email and letter from a resident in the 11th District. It’s an honor and a privilege to serve as your representative, and I hope to hear from you soon!

Survey on Credit Scoring

Because of the pandemic, the federal CARES Act placed a temporary hold on credit scoring, resulting in bureaus collecting inaccurate credit histories. Because insurers use these credit histories to set rates, the models they use are now unreliable.

The OIC issued an emergency rule to ban the use of credit scores in setting insurance premiums for the next three years, which will help ensure that insurance rates are not excessive or unfairly discriminatory.

The new rule is designed to protect those most greatly impacted by the pandemic from having to pay even higher premiums. It will also help people who will see their credit scores drop after federal CARES Act protections end.

Learn more about the OIC’s emergency rule and credit scoring.

Although the emergency rule is intended to provide positive change in the insurance industry, legislators are hearing concerns that the end result of the rule is problematic and harmful to consumers with a good credit score.

Although the emergency rule is intended to provide positive change in the insurance industry, legislators are hearing concerns that the end result of the rule is problematic and harmful to consumers with a good credit score.

I will work with my colleagues in the Legislature to explore ways to address this situation and find a solution that benefits all consumers. To be better able to tackle this issue, I need to hear from you about if and how this rule change has affected you. Please take a moment to take a survey, which should take less than five minutes of your time. Thank you and I look forward to your responses!

The WA Cares Fund: A first-in-the-nation long-term care benefit

Please note that while I am providing you this information on the current WA Cares Fund system, I have heard your concerns and am working with colleagues to address issues related to military families, those who live out of state and work in Washington, as well as potential changes to ease the transition into the new program.

Washington state is the first in the nation to develop a way to make long-term care affordable for all workers in the state as we age: the WA Cares Fund. Workers contribute up to $0.58 per $100 of earnings starting January 2022. Benefits would start January 2025, with up to $36,500 in long-term care services and supports. It is a lot like Social Security—everyone pays so that everyone who needs this benefit can access it.

Washington state is the first in the nation to develop a way to make long-term care affordable for all workers in the state as we age: the WA Cares Fund. Workers contribute up to $0.58 per $100 of earnings starting January 2022. Benefits would start January 2025, with up to $36,500 in long-term care services and supports. It is a lot like Social Security—everyone pays so that everyone who needs this benefit can access it.

I have heard from a number of constituents expressing concern and confusion about the program, so I am using this space to tell you about how the program works and answer some of your frequently asked questions. You can also learn more by visiting www.wacaresfund.wa.gov and joining the mailing list for updates.

Why do we need the WA Cares Fund?

The Fund was created to address an alarming gap in long-term care coverage. Before this summer, less than 10 percent of Washingtonians had private long-term care policies. Medicare does not cover long-term care, which forces people to spend down their life savings to qualify for Medicaid. Medicaid long-term services and supports represent 6.3 percent of the state budget and will continue to grow as our population ages. We all pay for these services now through regressive taxes like the sales tax.

The WA Cares Fund addresses this issue by ensuring families have affordable care to help their loved ones eat, bathe, dress, and manage their daily lives. WA Cares will help families with these costs without having to spend down their savings to receive Medicaid-funded services.

How does WA Cares compare to private long-term care coverage?

WA Cares is a first-in-the-nation program meant to provide working families more security as they and their loved ones age. It is not meant to replace commercial long-term care coverage but to give families alternatives to spending down their assets to qualify for Medicaid.

Commercial long-term care coverage is also expensive, restrictive and notoriously unpredictable. Rates can fluctuate wildly, with increases ranging from 20 percent to 79 percent. You can be turned down based on pre-existing conditions, and you will lose your benefit if you stop paying premiums.

Unlike commercial coverage, you don’t pay in to WA Cares when you’re not working, including after you retire. WA Cares is funded by a convenient automatic payment through your employer. You can still receive the benefit even if you leave your job.

And unlike commercial policies, WA Cares gives you flexible options and won’t deny coverage for pre-existing conditions. Commercial insurance often charges women 50 percent more than men. WA Cares costs the same for everyone.

Why make WA Cares mandatory?

WA Cares is intended to provide everyone with a long-term care benefit. Because some people purchased private long-term care policies before WA Cares was created and that coverage could be duplicative, the law allowed them a one-time opt out. The option to opt out was never intended to be a “loophole” to get out of participating in the plan, because it’s important that we all contribute to the long-term care system. Like Social Security or Medicare, if people opted out, no one would have those safety nets available.

Long-term care is expensive, isn’t covered by Medicare, and most families lack enough savings to pay for it. WA Cares is the next big step in our social safety net to ensure that Washingtonians can access benefits when they are needed, helping us create stable, healthier communities.

The maximum benefit isn’t enough for full-time long-term care, so what can I use it for?

WA Cares covers a range of services that help with personal care in your home, home-delivered meals, home modifications to accommodate wheelchairs, transportation, training for family members, and more. The idea is to help our loved ones age in their homes, not place them in expensive long-term care facilities that may not be right for them.

What if I move out of Washington state?

Right now, you must live in Washington state to collect a WA Cares benefit. That may change over time. But if you choose to purchase a private policy and opt out of WA Cares, that choice is permanent and can’t be changed. For most Washington residents, WA Cares is the best value for the benefits they will receive. There is a specific long-term care workgroup that is considering policy options to address this issue. We still encourage everyone to participate, because contributing now keeps your options open in the future.

What if I live in another state but work for a Washington employer?

Right now, people who work in Washington but live out of state would not be able to access WA Cares benefits. Similar to programs like Medicaid and Social Security, contributions are collected by your employer. And like other social safety net programs, the goal is to provide Washingtonians the benefits they need and bring stability to communities. While some people may not make use of safety net programs, our communities are healthier and stronger when families aren’t forced into poverty to receive the care they need. Our specific long-term care workgroup is considering policy options to address this issue, as well.

What if I am approaching retirement in the next 10 years?

In order to vest with and receive WA Cares benefits, you must contribute to the program for at least ten years at any point in your life without a break of five or more years, or three of the last six years, and work at least 500 hours per year during those years. That contribution is about half a percent or 58 cents for every $100 earned. For some, the timeline for vesting may conflict with retirement. We are interested in hearing from you if you are in this situation. Our specific long-term care workgroup is also considering policy options to address this issue.

Proposed redistricting maps are online

Once every 10 years, the political boundaries in our state are redrawn to evenly balance the population among each legislative and congressional district. Doing so ensures each district represents an equal number of residents, because communities and populations change over time.

In our state, an independent redistricting commission is charged with redrawing these boundaries. The commission is made up of four commissioners that are each appointed by the four legislative caucuses, plus a fifth nonvoting commissioner. Last month, the commissioners each released their proposed legislative and congressional maps. These proposed maps can be viewed online here.

In our state, an independent redistricting commission is charged with redrawing these boundaries. The commission is made up of four commissioners that are each appointed by the four legislative caucuses, plus a fifth nonvoting commissioner. Last month, the commissioners each released their proposed legislative and congressional maps. These proposed maps can be viewed online here.

Now it’s YOUR chance to weigh in. A public outreach meeting on the proposed legislative maps already took place on Oct. 5th, but you can still leave a comment on each commissioner’s map even if you didn’t attend the meeting. And you can watch a replay of the full meeting here in English, Spanish, or with ASL interpretation.

I hope you’ll add your voice to the conversation. It is critical that the commission’s final maps reflect the input of the people and communities of our state. To ensure the commission considers your comments, I would encourage you to provide feedback prior to the end of next week, October 22.

Have your say on how to modernize our tax code

Washington state’s tax structure places a heavier burden on working families and small businesses than those at the very top of the income bracket. This is unfair and needs to change. Two years ago, the legislature created the Tax Structure Workgroup to engage all taxpayers—individuals and families, businesses large and small—on ways to create a more equitable, transparent, and stable tax code.

This is YOUR chance to share your input!

On Wednesday, October 27, I hope you can join one of the Tax Town Halls for residents and businesses in the North/Central Puget Sound Region—which includes the 11th Legislative District:

Afternoon session: 2:30-4:00 p.m.—click here to register

Evening session: 6:30-8:00 p.m.—click here to register

Learn more about the Tax Structure Workgroup.

Voting Rights Survey Results

Washington state has long been a leader in promoting access to the ballot, and in recent years we have passed significant election reform legislation that are helping increase participation and improve representation, both of which are necessary for a healthy democracy.

More recently, states across the nation are considering policies to restrict access to the ballot, while some have even been introduced here in Washington. To better understand your thoughts and concerns around voting rights and access to the ballot, I put together a quick survey. Thank you to everyone who shared their thoughts and concerns!

For more information, check out the 11th District Voting Rights Survey results.

Sincerely,

Rep. Steve Bergquist