We are currently in week 13 of the legislative session, and I would like to give you an update on what we’ve been working on here in Olympia.

Last week the Senate released a budget proposal following Governor Inslee’s rollout of his plan in the previous week.

House Budgets

The House Democrats unveiled our proposal earlier today. My colleagues and I are committed to a budget for the next two years that will support our schools, address the needs of the vulnerable, and maintain public safety and other vital state services for the next two years. I believe our proposal is much more in line with Washington’s values than what was proposed by the Senate. A revenue and education package has been proposed to provide the funding necessary to implement the budget. New revenue will be generated by eliminating or reducing current tax preferences.

The House Democrats unveiled our proposal earlier today. My colleagues and I are committed to a budget for the next two years that will support our schools, address the needs of the vulnerable, and maintain public safety and other vital state services for the next two years. I believe our proposal is much more in line with Washington’s values than what was proposed by the Senate. A revenue and education package has been proposed to provide the funding necessary to implement the budget. New revenue will be generated by eliminating or reducing current tax preferences.

The House has also released a Capital Budget proposal for $3.6 billion. This includes almost $500 million for K-12 construction assistance and puts $51 million into the Housing Trust Fund. Approximately forty-five thousand jobs are projected to be generated by this budget.

There will still need to be serious negotiations between the Democratic House and the Republican Senate before our budget work is complete. I am committed to meeting all of our state’s obligations, especially fulfilling our constitutional obligation to fully fund education. I will support additional revenue in order to meet these goals.

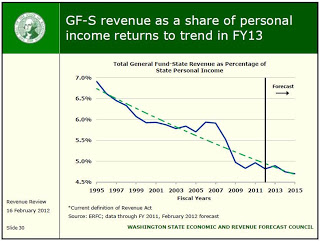

Personal Income is up; State Revenues are Down

The total personal income in the state of Washington rose by 4.5% from 2011 to 2012, the fourth-highest percentage increase among the states according to the U.S. Department of Commerce.

The total personal income in the state of Washington rose by 4.5% from 2011 to 2012, the fourth-highest percentage increase among the states according to the U.S. Department of Commerce.

So at least some people saw their income go up last year, which is certainly good news.

It seems reasonable to assume that would generate additional revenue for the state budget, since a portion of those increased earnings might be spent on goods that are covered by the state sales tax.

However, that hasn’t been the outcome. Over the last 20 years, state tax rates as a share of personal income have dropped sharply. Washingtonians today pay a much smaller percent of their income for education, public safety, the State Patrol, bridges and highways, foster care and all the other services the state provides than they paid in 1995.

Working to Prevent Gun Violence

Two House bills that tighten critical areas of firearms regulation moved another step closer to final Legislative approval this week when they cleared the Senate Law and Justice Committee.

House Bill 1840 would prohibit possession of a firearm by anyone subject to certain restraining orders, no-contact orders or protection orders if a judge finds that the subject of the order poses a threat to an intimate partner or the child of an intimate partner. Those who fall under the finding and already have guns would be required to surrender them to police. The Senate committee added the requirement for both an order and a court finding of a threat to the version of the bill that earlier passed the House 61-37. The House-passed version would trigger the gun prohibition in the case of either an order or a finding of a threat. A recent New York Times article looks at how states nationwide deal with gun rights and restraining orders. If the amended bill is approved by the full Senate, it would return to the House, which can either accept the Senate change or negotiate a compromise version acceptable to both chambers. The Senate committee also approved House Bill 1612 which sets up a statewide data base to log felony firearms offenders. The data base is designed to aid law-enforcement officers and would not be available for public viewing. It previously passed the House 85-10. |

Thank you for subscribing to my newsletter. If you have any questions or concerns about pending legislation or the budget, please feel free to contact my office.

Sincerely,