While most people take little enjoyment in paying taxes, they also understand that we all have an obligation to pitch in our fair share to help pay the cost of a civilized society. Things like law enforcement, education, public safety, elections, etc., are all things that most Washingtonians appreciate and are happy to invest in.

However, a tough truth about how we pay for those investments is becoming ever-clearer. Simply put, we don’t levy our taxes in the fairest or most just of ways.

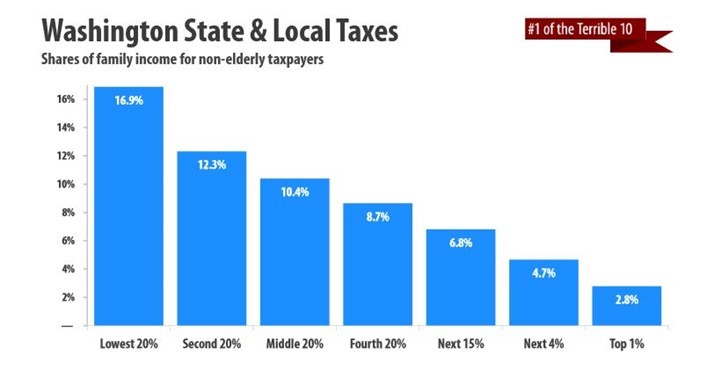

In 2013 the Institute on Taxation and Economic Policy (ITEP) published a study that ranked Washington’s system of taxation as the most regressive in the country. The graph below illustrates how upside down our system is with poor Washingtonians paying the highest percentages of their income to support the state.

Now, a personal finance website, WalletHub has produced their own study with identical findings.

WalletHub found that among states where the top 1% are most undertaxed, Washington ranks seventh. Among states where the poor (bottom 20%) are the most overtaxed… Washington ranks first.

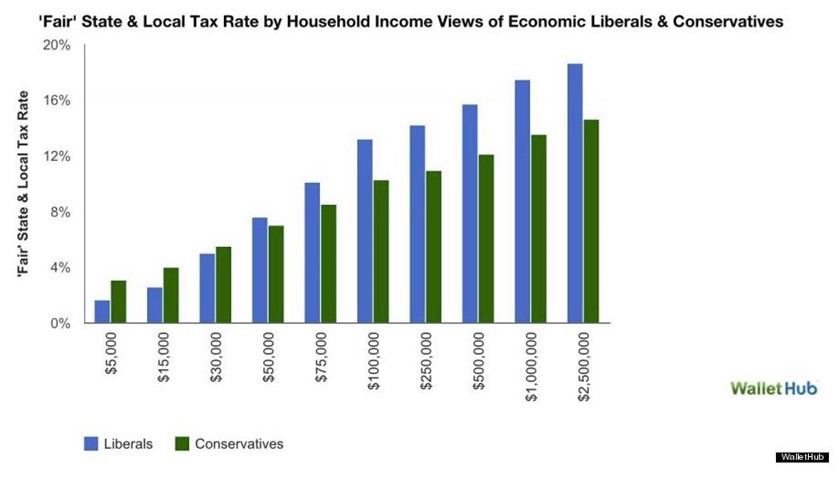

The good news is… it doesn’t have to be this way. According to WalletHub’s study, there exists some consensus on just what may constitute a more fair system. While the following graph shows a divide among liberals and conservatives over just what levels of taxation are fair, even the conservatives in this survey showed a preference for a progressive tax rate.

In other words, both liberals and conservatives agree that the poor should pay lower rates, and the wealthy should pay higher rates. Yay for consensus!

In other words, both liberals and conservatives agree that the poor should pay lower rates, and the wealthy should pay higher rates. Yay for consensus!