A recent report featured on KING5.com reveals that Washington has the worst taxes on average earners. In fact, the article says that “according to ‘Who Pays? A Distributional Analysis of the Tax Systems in All 50 States,’ a report released by the Institute on Taxation and Economic Policy (ITEP), Washington has by far the most regressive tax system nationwide.”

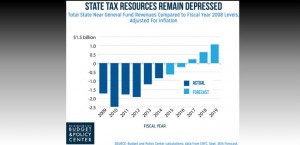

Since Washington state doesn’t have a progressive income tax like the federal government, we rely mainly on sales, property, and business & occupation taxes. We mitigate the regressive effects to some extent for low earners by not taxing food, which is a greater percentage of low earner wages vs. high earner wages. But those revenue sources suffered significantly during the Great Recession, and still remain depressed, leaving the Legislature with limited options on how to fund the growing demands on the state.

Since Washington state doesn’t have a progressive income tax like the federal government, we rely mainly on sales, property, and business & occupation taxes. We mitigate the regressive effects to some extent for low earners by not taxing food, which is a greater percentage of low earner wages vs. high earner wages. But those revenue sources suffered significantly during the Great Recession, and still remain depressed, leaving the Legislature with limited options on how to fund the growing demands on the state.

From the article:

The poorest 20% of families paid nearly 17% of their income in state and local taxes, the highest such rate nationwide. With the wealthiest 1% of state households paying just 2.4% — nearly the lowest such rate — Washington’s tax system helped widen the income gap more than any other state.

Washington’s poorest residents paid nearly seven times what the wealthiest 1% paid as a share of income, one of the highest such ratios nationwide. While Washington’s tax code is considered by many to be among the nation’s most unfair, residents are better-off financially than in many other states.

Since we are better off than the national average, many may not notice or even forget that our tax system greatly benefits the top wage earners. But when we fund the budget on the backs of our lowest wage earners, we find ourselves in the position of being recognized as the worst state for taxes on the low and middle class populations.

Taxing the poor at effectively higher rates than the top one percent – is this fair?