Greetings from Olympia!

A little over a week ago, the House and the Senate debated our proposed budgets. I am proud of the budget passed out of the House – this budget reflected our shared values.

Educational Opportunities for All

The House budget will ensure that every child in Washington State receives excellent educational opportunities from pre-K through college by investing $227 million in early learning, adding $1.4 billion in our K-12 system to help us meet our McCleary obligations, and investing $256 million in higher education (including a tuition freeze at our state schools, and increasing need grants and scholarships).

Protecting the Social Safety Net

Our budget also protects our most vulnerable. After years of cuts to our social safety net, we make meaningful investments in our state food and emergency food assistance programs, and increase child support by at least another $100/month to needy families.

Protecting our Environment

Our budget also protects investments in our environment by protecting our Public Works Assistance Fund, supporting programs that keep our air and water clean, and our state parks open.

How Do We Pay for These Programs?

I don’t accept the idea that we must cut social service programs and environmental programs to add new investments in our education system (remember, we have cut programs for our most vulnerable for the last several years).

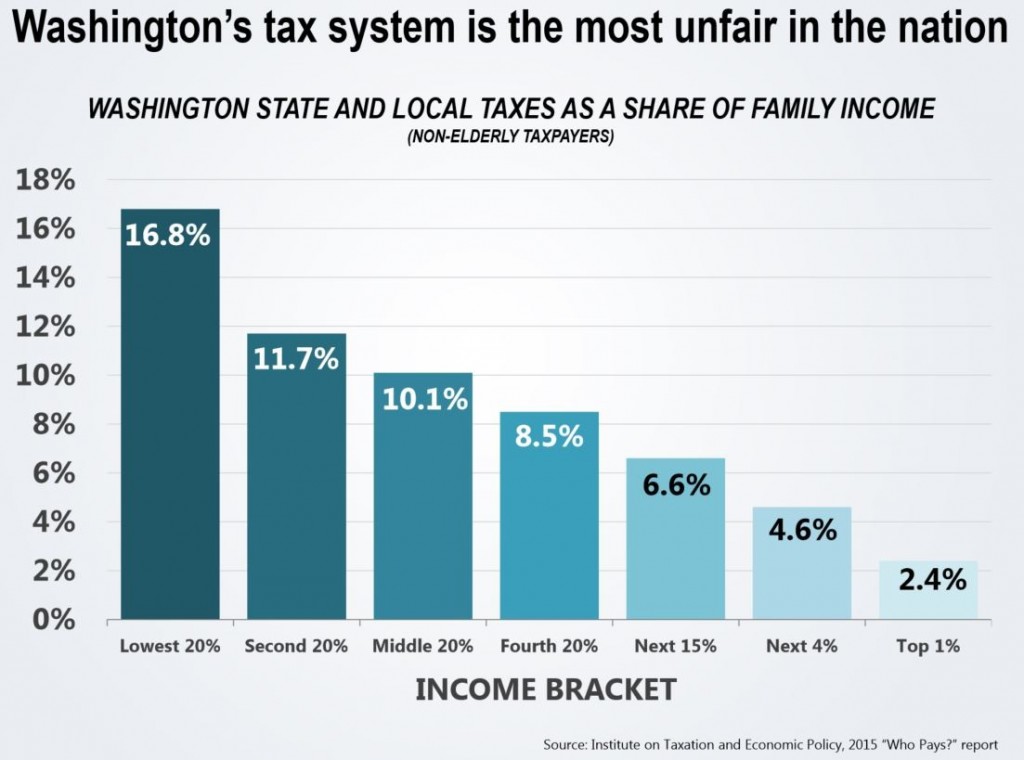

In order to fund these programs, we propose a capital gains tax, an extension of our B&O tax to services, and we close some unproductive tax loopholes. Our state has the most unfair tax system in the nation. You read that right, the most regressive of all 50 states. That means that middle-class and working families pay four to seven times more of their income in taxes than the wealthiest five percent.

The House is proposing a 5 percent tax on capital gains when a person makes more than $25,000 in profit (or $50,000 for joint filers) from the sale of stocks, bonds and other investments. This tax will impact only about 32,000 of Washington’s wealthiest individuals and families. The tax would completely exempt retirement accounts, most primary residences (up to $250,000 for single filers and $500,000 for joint filers), and most sales of agriculture lands and timber. In an almost unprecedented turn, even the Seattle Times supports this sensible, measured, fair way to begin to address the structural problems in our revenue system.

The Senate Republicans have claimed that they can balance our state budget without new taxes, but their budget only balances with some pretty big transfers of funds. Transferring funds to pay for state services isn’t sustainable – it’s like using your children’s education fund to pay your rent. The college fund will run out, leaving you unable to pay rent and your kid won’t be able to pay for college.

Clearly, the House and Senate have two very different proposals but negotiations are on-going and I will be looking for a final budget compromise with significant investments in our education system while at the same time keeping the social safety net intact.

Updates on my bills

Oil Transportation

My oil transportation safety act is still moving forward. It has passed through its committees in the Senate, and could be voted on in the Senate floor at any time. With the significant increase of shipping oil by rail, our communities are in danger. My bill will give our first responders the information they need to properly prepare for these shipments, provide the public with more information about what is coming through their communities, increase safety inspections along our rail lines, and ensure that we can pay for these programs. I am very hopeful that we will see passage of this important legislation this session.

Minimum Wage

Unfortunately the Chair of the Senate’s Commerce and Labor committee refused to schedule my bill to raise the minimum wage for a vote in his committee before cutoff, and the bill has died for this session. My proposal was modest – raising the minimum wage to $12/hour over four years. I am proud, though, of the progress we made this year – it passed out of the House and got a hearing in the Senate. I will continue to fight for this and other bills to help Washington’s workers.

Transportation

The House released our proposed Transportation Revenue Package earlier today. Unlike the Senate’s plan, we will be giving Sound Transit the full $15 billion in taxing authority that they need to build out the spine of our light rail infrastructure. We also won’t be tying the Governor’s hands when it comes to dealing with climate change, and won’t be funding infrastructure whose only purpose is to enable a new coal export terminal on our waters. This plan also funds needed projects in the 46th district – projects like the Northgate Ped/Bike Bridge, the replacement of the West Sammamish Bridge, major improvements on the Burke-Gilman trail, and completion of the SR 522 project in Kenmore.

I have been working very hard behind the scenes to mold this package into one we can all be proud of, and I am very hopeful that the House and the Senate will be able to get to “yes” on this package.

Keep in Touch

As always, I love hearing from you! Feel free to email me at jessyn.farrell@leg.wa.gov with your thoughts and concerns. And if you find yourself in Olympia, please stop by the office and say hi!

All the best, -Jessyn