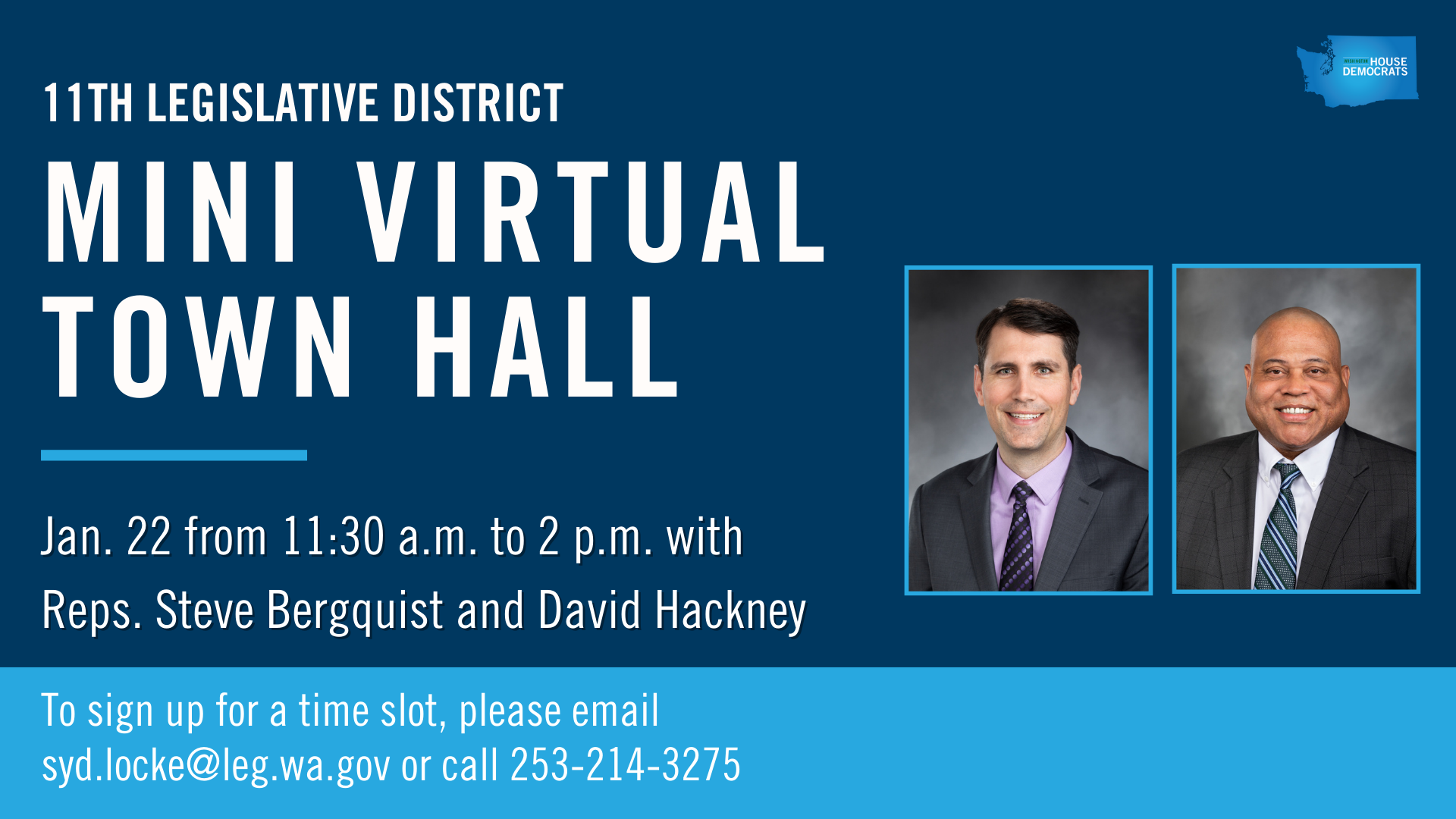

Welcome to the second day of the 2022 Legislative Session! Now that session is in full swing, I’ll be hosting a mini virtual town hall with Rep. David Hackney on Jan. 22 from 11:30 a.m. to 2 p.m. We want to hear from you! If you have any thoughts or concerns you’d like to share, I hope you’ll reach out to sign up for a 15-minute time slot. Please email syd.locke@leg.wa.gov or call 253-214-3275 to schedule a call with us on Zoom or over the phone.

Share your legislative priorities

Our democracy is strongest when everyone can participate, so I’m looking for your input on some of the issues that will likely come up in the Legislature this year. If you have feedback on a topic that’s not included in the survey, please feel free to email me.

You can click here or on the button below to fill out the survey, which should take less than five minutes of your time. Thank you, and I look forward to your responses!

You can also check out the results from our previous survey here. More on that below!

Changes to the long-term care program

Thank you to everyone who has reached out about the WA Cares Fund, our state’s new long-term care program. For more information about the fund, visit this link or check out this newsletter where I answered some frequently asked questions.

Gov. Jay Inslee and Democratic lawmakers announced last month that the program will be delayed to give legislators time to make changes. Here’s what I’m supporting to make sure WA Cares is available to everyone:

- Two bills, HB 1732 and HB 1733, that extend the rollout of the program, give people close to retirement a chance to qualify for the fund and offer exemptions to military spouses, disabled veterans and border state workers

- Budget plans to determine how to make WA Cares portable for people who move out of Washington state after they vest into the program

WA Cares is vital for our aging and disabled population and their families. If we don’t implement this program, with the needed changes, our state faces a long-term care cliff. Without action, state spending on Medicaid-funded long-term care will skyrocket by 91% to more than $4 billion per year.

Most families don’t have a plan for their long-term care or an insurance policy to protect them. That means families are spending their savings to qualify for Medicaid, relying on unpaid family members for basic services or being forced to sell their homes and move into long-term care facilities, even if they don’t need that level of care.

We can’t accept our current system that often bankrupts our most vulnerable, denies people with pre-existing conditions or forces people from their homes. We need to help families plan for their future and stay in their own homes as they age. That’s what WA Cares does and why it’s so important we make sure it works for as many people as possible.

Stay tuned for more updates as these bills move though the legislative process!

The latest on higher insurance rates

In March, the Office of the Insurance Commissioner (OIC) filed an emergency rule to ban the use of credit scores in setting insurance premiums for the next three years — until 2024. Consumer advocates have long raised concerns about the inherent racial and economic biases in credit scoring systems, including using credit histories in calculating private insurance (auto, renters and homeowners), while the insurance industry claims credit histories are the best predictive tool for determining risk.

However, many concerns have been raised about the emergency rule, including that the process was rushed, and the rule implemented without enough deliberation, as well as that the result would be harm to consumers with a good credit score, especially seniors.

As I reported back in October, the insurance industry filed a lawsuit in Thurston County Superior Court, and the court overturned the OIC emergency rule. At this time, it’s still unclear what the impacts will be to consumers, as the OIC has a few choices in how to move forward. They may appeal the court’s ruling, but they are also currently going through the normal rulemaking process, which can take months or longer. It’s been speculated that insurers will not make any changes to rates until additional clarity and direction is received from the OIC, so Washingtonians shouldn’t expect to see any immediate rate changes.

The use of credit scoring in insurance is an issue that the Legislature is likely to consider in the upcoming session, and your input will help lawmakers have examples to help inform our decision-making. For example, SB 5623 was recently introduced in the Senate and would limit insurers’ use of credit histories to increase personal insurance premiums at renewal. Please feel free to share your story with my office.

To better understand how to tackle this issue, I put together a quick survey on if and how this rule change has affected you and your loved ones. Thank you to all those who shared their thoughts and concerns! For more information, check out the 11th District emergency credit score rule survey results.

Welcome to the 2022 virtual session

It’s the first week of session, and we’ll be doing most of our work remotely to help keep the public, staff and lawmakers safe. Just like last year’s virtual session, you can still watch committee meetings and floor sessions at tvw.org and participate in the lawmaking process without having to travel to Olympia. For more information about how to stay involved, including testifying in a virtual hearing and submitting written testimony on a bill, visit this link.

Thanks for reading! It’s an honor to represent the 11th Legislative District. Please don’t hesitate to send me an email or give me a call at 253-214-3275. I hope to hear from you!

Sincerely,

Steve Bergquist