Washington’s three budgets

While our budget teams have been hard at work since the beginning of session developing budget proposals, this week was the official unveiling of the House Democratic budget plans for the next biennium. Washington has three different budgets. Although they each fund a different function of state government, I believe all three of them together are a vision for the future of our state.

The capital budget, sometimes called the construction budget, is how the state invests in buildings and other long-term assets. Much of our work to increase affordable housing and address environmental restoration comes from this budget. The transportation budget is how things like roads, ferries, and bridges are built and maintained. Money for this budget comes mainly from the state gas tax, which can only be spent on transportation-related matters as mandated by the state Constitution. Finally, the operating budget is the largest of the budgets and pays for everything else, including behavioral health, education, social services and many other important programs. Throughout this week, I worked with my fellow Appropriations Committee members to refine the operating budget and pass it out of Committee. The budgets now go to the House floor for consideration.

Operating budget: Making investments in our state

House Democrats’ operating budget is a strong reflection of our values and our vision for a future that puts people first. The budget makes additional investments in critical areas of the state budget such as behavioral health, affordable housing, education, environment, and a new Workforce Education Investment.

Click or tap the image to watch a short video highlighting the “Putting People First” operating budget.

I want to give you some of the highlights in the $52.6 billion 2019-2021 budget, but you can also take a look at the budget documents here.

- Significant investments in continued efforts to fix the state behavioral health system, including expanding community behavioral health beds and services.

- Investments in housing programs and services for permanent supportive housing, youth homelessness, and the Housing and Essential Needs Program.

- Educational investments include fulfilling the promise to fund health care coverage for school employees, funding for special education, levy assistance for areas with low-property values, and student mental health and safety.

- Other investments include expanding the Early Childhood Education and Assistance Program slots; eliminating the backlog in testing sexual assault kits; improving salmon habitat and protecting Orcas; increasing our wildfire response and addressing natural disasters.

Revenue plan: A balanced approach for Washington’s investments

Washington has a tax problem. Too many powerful special interests have carved out a place in our tax code, keeping our state from adequately investing in working families.

We have an upside-down tax code that forces the poorest among us pay the largest share of their wages in sales tax, people are seeing their property taxes skyrocket, and businesses are cutting deep into their margins to pay their tax bills. When the legislature needs to invest in K-12 education, financial aid for college students, or high quality pre-kindergarten, the burden falls on the middle class and the elderly.

Extraordinary Profits Tax – A targeted 9.9 percent excise tax that only applies to the sale of very high value assets like stocks and bonds. Every sale or transfer under $200,000 for couples and $100,000 for single-filers will be TOTALLY exempt. Retirement accounts; single-family, duplex, and triplex homes; most agricultural and farm-related sales; and certain qualifying small businesses are also 100 percent exempt.

Progressive Real Estate Excise Tax –Currently, all Washington property sellers pay the same 1.28 percent flat tax rate. We propose reducing that rate for 80 percent of home sellers to .9 percent, with a graduated increase for the most expensive homes. The adjustment would top out at 3 percent for homes over $7 million. Even in higher property value areas like the 32nd District, most homeowners will NOT see changes in their home sale tax rate.

Workforce Education Investment – Washington jobs should go to qualified Washington workers. This means students need expanded access to post-high school opportunities so they can fill the jobs of the future. Businesses need these workers and they support funding the Washington College Grant. Here’s how Microsoft and UW leaders want to better fund higher education.

I hope you’ll join me in supporting this proposal that really focuses on investing in our future by asking the wealthiest in our state to chip in just like the rest of us.

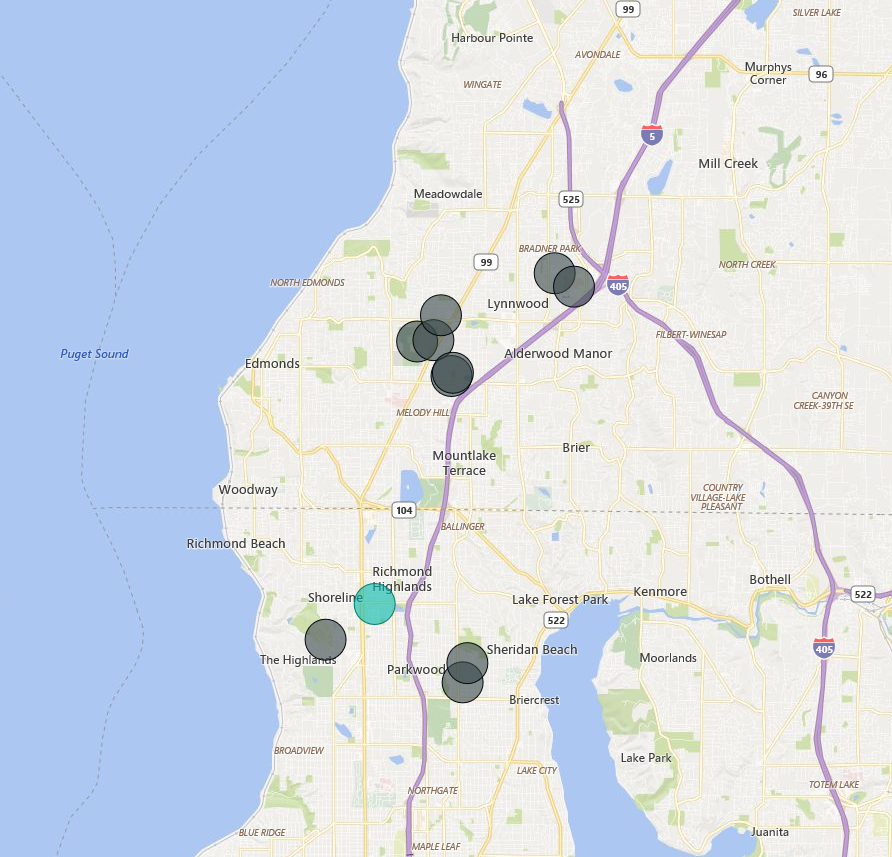

Capital budget: Building schools, affordable housing, and more

Our capital budget proposal makes investments in every corner of the state, such as $1.1 billion for public school construction, $927 million for public colleges and universities, $155 million for affordable housing, $463 million to help salmon and orcas, and $117 million for community behavioral health facilities. These projects will help address many of the pressing issues we are facing, while also putting people to work all over our state.

There are over $42 million in new appropriations for projects in the 32nd district:

- Lynnwood Sea Mar Behavioral Health Expansion

- Shoreline Communiuty College: Allied Health, Science & Manufacturing Replacement

- Edmonds Community College: Science, Engineering, Technology Bldg

- Lynnwood Sea Mar Behavioral Health Expansion

- VOA Lynnwood Center

- South Snohomish County Community Resource Center

For more information, check out the capital projects list by district interactive page. Be sure to select “House Chair” version, choose the 32nd District from the drop-down menu, then click “view report.”

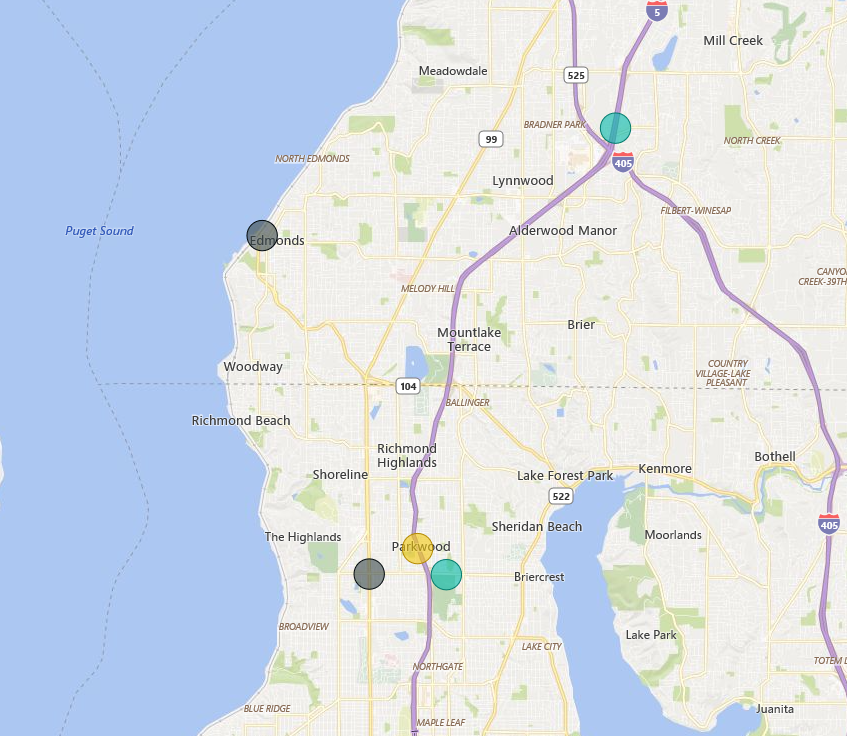

Transportation budget: Keeping our growing population on the move

The $10 billion transportation budget proposed by House Democrats makes investments in each part of the state to get people where they need to be and get goods shipped around the world. It includes major funding to remove fish-barriers on state roads as part of the broader solution to helping our struggling orca population. I’m also particularly glad that we are funding a Studded Tires Education Project to help inform people that there are better and safer alternatives for winter driving.

There are nearly $28million in new appropriations for projects in the 32nd district:

- 148th Street nonmotorized bridge spanning I-5 in the proximity of N 148th st in Shoreline

- SR 523/145th Street for design, rights of way purchasing, and construction funds. This resulted form the corridor study in the previous transportation budget to identify improvements for the safety for all road users, and improve transit speed reliability and access.

For more information on projects in our area, check out the transportation projects list by district interactive page. Be sure to select “HTC Chair Proposed” version, choose 32nd District from the drop-down menu, and then click “view report.”

Thank you for reading this update. Please be sure to contact my office with your questions and feedback.