Dear Friends and Neighbors,

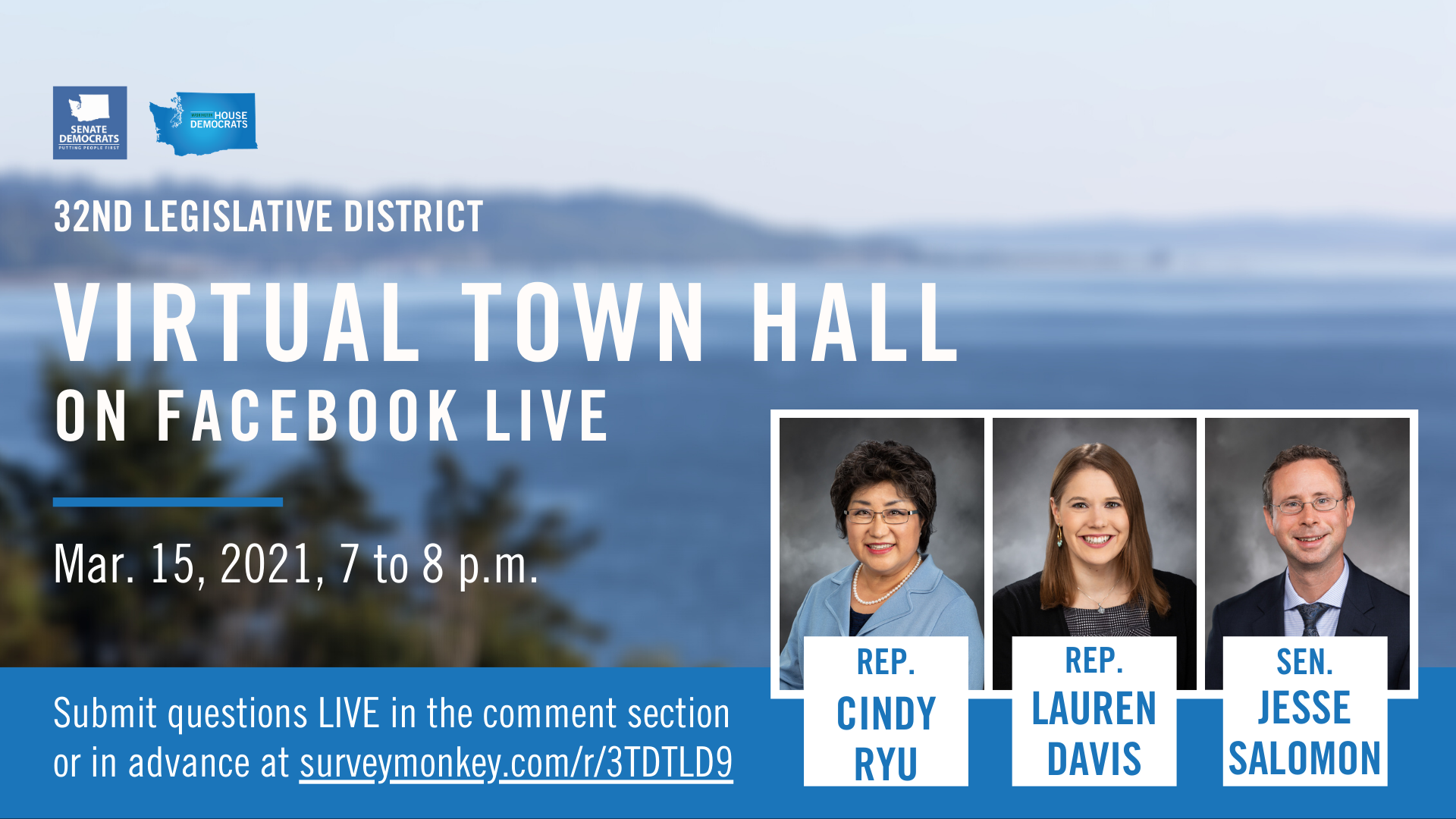

On Monday, March 15 from 7-8 p.m., I am hosting a virtual town hall with my 32nd Legislative District seatmates, Rep. Lauren Davis and Sen. Jesse Salomon. I hope you can join us to hear an update on the legislative session, and so we can hear your questions, thoughts, concerns and hopes for this session and our state.

Hearing directly from you is the best way to ensure we are best serving the needs of our community. I hope you’ll join us.

Click here or on the image below to RSVP. The event will stream live on Facebook (you do not need a Facebook account to watch) and on YouTube and Twitter @WaHouseDems. You can submit questions and comments live during the event in the chat box, or beforehand here.

Thanks for taking the time to read this update,

Ask Cindy

Take a look at my latest video where I respond to constituent questions about expanding child care and early learning programs, and fully funding long-term care.

The Washington State Wealth Tax

Washington has always been a great place to live and work, but that is going to change if we don’t address the fundamental and systemic problem of our inequitable tax structure. People like you and me pay for schools, public health, housing and homelessness programs, public safety, and other vital government functions while the wealthiest households – some of whom are common household names we all know – pay far less than they should. Middle-class Washington families pay four times more in taxes than the highest-income households in our state, as a share of their income, and that matters because it means we – rather than the wealthiest among us – are the ones expected to pay for schools, safety programs, and homelessness services. For the lowest-income households – those making $24,000 or less per year, it is even worse, as they pay six times more in taxes as a share of their income.

I support the Washington State Wealth Tax because it makes things a little better for Washington’s working families. Instead of continuing to rely on sales tax and tax on real property for the majority of our state’s revenue, the wealth tax could be a new tool in the tool box that taxes the financial assets billionaires use to make their fortunes at one percent and exempts the first $1 billion of wealth, making the tax barely a blip on the radar for someone who makes billions or hundreds of millions in a single year. If your net worth doesn’t add up to more than a billion dollars, you won’t be paying this tax. I know I won’t ever in my lifetime.

If we don’t pass this tax, our state will continue to over-rely on low- and middle-income families to pay for the vital government programs and functions our communities need. Washington’s wealthiest residents can and should share more equitably in the responsibility of funding these key community programs alongside their neighbors. If we are ever going to invest in better schools, get struggling families into stable housing, and reduce our reliance on working families to pay for it all, we must start asking the wealthy to contribute like the rest of us do.

The Washington Privacy Act comes to the People’s House

Every day that we use our smart phones and computers, we leave behind a digital trail of data regarding our movements, online searches, shopping choices, work, and fitness activities. With increasing frequency, and often without our awareness, this data is used for targeted advertising or sold directly to another company. This year two proposals to regulate the collection and use of consumer data are under consideration. In the House, the People’s Privacy Act was introduced, and the Senate is considering the Washington Privacy Act. Both bills seek to create new privacy rights for our consumer data. Both bills would give consumers the right to decide what data companies collect on you, for what purpose it can be used, who can use it, and to have it deleted.

The People’s Privacy Act is different in two important ways. The first is that it would make data collection an opt-in feature as opposed to the current opt-out option that most companies and applications offer. Instead of having to request that companies delete your data, you could simply never allow them to access it in the first place. The second important distinction is that the People’s Privacy Act includes a private right of action. This would allow an individual to sue a company that was violating their data privacy rights. Under the Washington Privacy Act, only the Attorney General can enforce violations under the Consumer Protection Act. I believe that a right is meaningless if there is not a way for an individual to enforce that right.

Only the Washington Privacy Act is moving forward this week after the “policy committee cutoff,” one of the Legislature’s deadlines for legislation to move through the committee process. However, the Washington Privacy Act will be heading over to the House to be considered in the House Civil Rights & Judiciary Committee. Having set out the principles we believe in with the People’s Privacy Act, I am hopeful that here in the House, we can continue to shape this bill and ensure that the Washington Privacy Act creates a meaningful way to enforce these new rights. I will continue to fight for consumer-focused data privacy protection.

Special health care enrollment period

The Washington Health Benefit Exchange (Exchange) opened a special enrollment period on Feb. 15 for Washingtonians. This aligns with President Biden’s executive order to re-open the federal health insurance marketplace, giving additional time to Americans still seeking health coverage during the pandemic.

The special enrollment will run for 90 days, ending May 15, 2021. During this time those currently uninsured, seeking coverage, or enrolled in off-Exchange health insurance (such as health sharing ministries, short-term limited duration plans or COBRA) can enroll. Current Exchange enrollees will not be eligible for this special enrollment. Visit the Washington Healthplanfinder here for more information.