Funding Child Care with a Capital Gains Tax

Last week, I introduced legislation that will help our state invest in much needed child care and early learning. House Bill 1496 will help bolster economic recovery and the economic well-being of working families by funding the expansion and affordability of child care through a capital gains tax.

Last week, I introduced legislation that will help our state invest in much needed child care and early learning. House Bill 1496 will help bolster economic recovery and the economic well-being of working families by funding the expansion and affordability of child care through a capital gains tax.

The proposal will also help address the systemic inequities in our state tax code. Washington State has the most regressive tax code in the nation. Working families are funding a disproportionate share of schools, public health, public safety, and other vital government functions while the wealthy pay proportionately less.

To ensure the capital gains tax avoids taxing working families, there are several exemptions including the sale of primary residences valued under $5 million, the sale of family businesses with gross revenue of $10 million or less, and retirement accounts, to name just a few.

Passing this capital gains tax, with exemptions to avoid taxing working families, would help ensure the wealthiest Washingtonians share in the responsibility of funding key programs and services our communities need, such as the much-needed investment in child care.

By enacting this tax, we’ll kickstart our economy, provide resources to invest back into our communities, help rebalance our upside-down tax code, and give kids across our state a fair start.

House Bill 1496 was heard in the House Finance Committee this morning! Watch the hearing.

Additional details, including tax rates and exemptions, are available in my recent press release.

Unemployment Insurance relief for businesses and workers

My office receives emails and calls on many different issues daily. This year, the coronavirus and its consequences have taken center stage–from struggling workers whose unemployment benefits are just not enough to support their families and from business owners who are facing unprecedented hikes in their Unemployment Insurance premium tax bills–up to 500% in some cases!

The urgency of this matter could not be overstated. We had to take action right away. So the first week of session, the chairs of the labor committees in both chambers introduced bipartisan, identical bills (SB 5061 / HB 1098) to bring relief for both businesses and workers.

After strong, bipartisan votes in the House and Senate, Governor Inslee signed it into law on Monday!

Business owners will breathe easier seeing the reductions in their UI tax bills due in April, and the state’s hardest-hit, lowest-wage workers will see a 5% raise in their unemployment benefits!

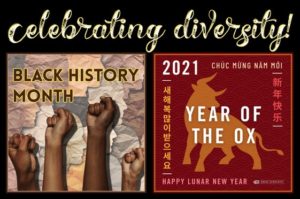

Celebrating Diversity

February is Black History month and includes the Lunar New Year. I feel very fortunate to represent an extremely diverse legislative district and live in a nation where we’re free to celebrate our many cultures and heritages. Make no mistake, it is the diversity of our people that makes us truly strong.

February is Black History month and includes the Lunar New Year. I feel very fortunate to represent an extremely diverse legislative district and live in a nation where we’re free to celebrate our many cultures and heritages. Make no mistake, it is the diversity of our people that makes us truly strong.

Did you know? The very first Legislative Session held in our state was in 1889. Many of the members were farmers, including William Owen Bush, a Thurston County Republican who introduced the bill that established Washington State University. He was the first African-American to ever serve in the state House of Representatives. Today, I am proud to serve alongside nine Democratic Black legislators (eight in the House and one in the Senate), who together comprise the largest Black Members Caucus in Washington’s history.

Special congratulations to all the families in our district who celebrate the Lunar New Year. May the Year of the Ox smile upon you and bring joy, prosperity and, above all, health.

As always, whether in person or online, please don’t hesitate to reach out to me this session with your questions, concerns, or comments. We will get through these hardest of times together.

Sincerely,

![]()

Rep. Tana Senn