Dear Friends and Neighbors,

With the beginning of week 6 of legislative session, I have drafted and submitted 22 bills and introduced numerous budget requests that benefit our communities. In this issue, I’ll provide an update on some of my bills to protect victims of abuse, highlight the meaningful work my colleagues are doing, and discuss the Working Families Tax Credit. I hope you will find it useful!

Addressing Child Abuse

As a vulnerable group being raised in a technological age with increased danger, children need serious protection. Bad actors might seek out children who do not have a safety net, and home may sometimes not be safe places for children. As adults, we have a responsibility to prevent harm to them. I am proud to have introduced multiple pieces of legislation to protection children from trafficking, increase access to reporting abuse, and support children in having economically stable homes to grow up in.

House Bill 1059 – Child trafficking is happening in our home towns. We must do everything in our power to stop it. This bill attempts to protect children from exploitation by limiting the manner and intent with which children can be photographed and recorded. My colleagues agreed with this legislation and passed it unanimously from the House Committee on Community Safety, Justice, & Reentry.

House Bill 1098 – Those in certain professions such as nurses, teachers, law enforcement officers, and others are required by law to report child abuse and neglect for the protection of a minor. Yet, Washington is 1 of only 7 states that doesn’t require members of the clergy to report suspected child abuse. This bill would expand that requirement to members of the clergy. On January 20th, the House Committee on Human Services, Youth, & Early Learning voted to pass this legislation on to the Rules Committee.

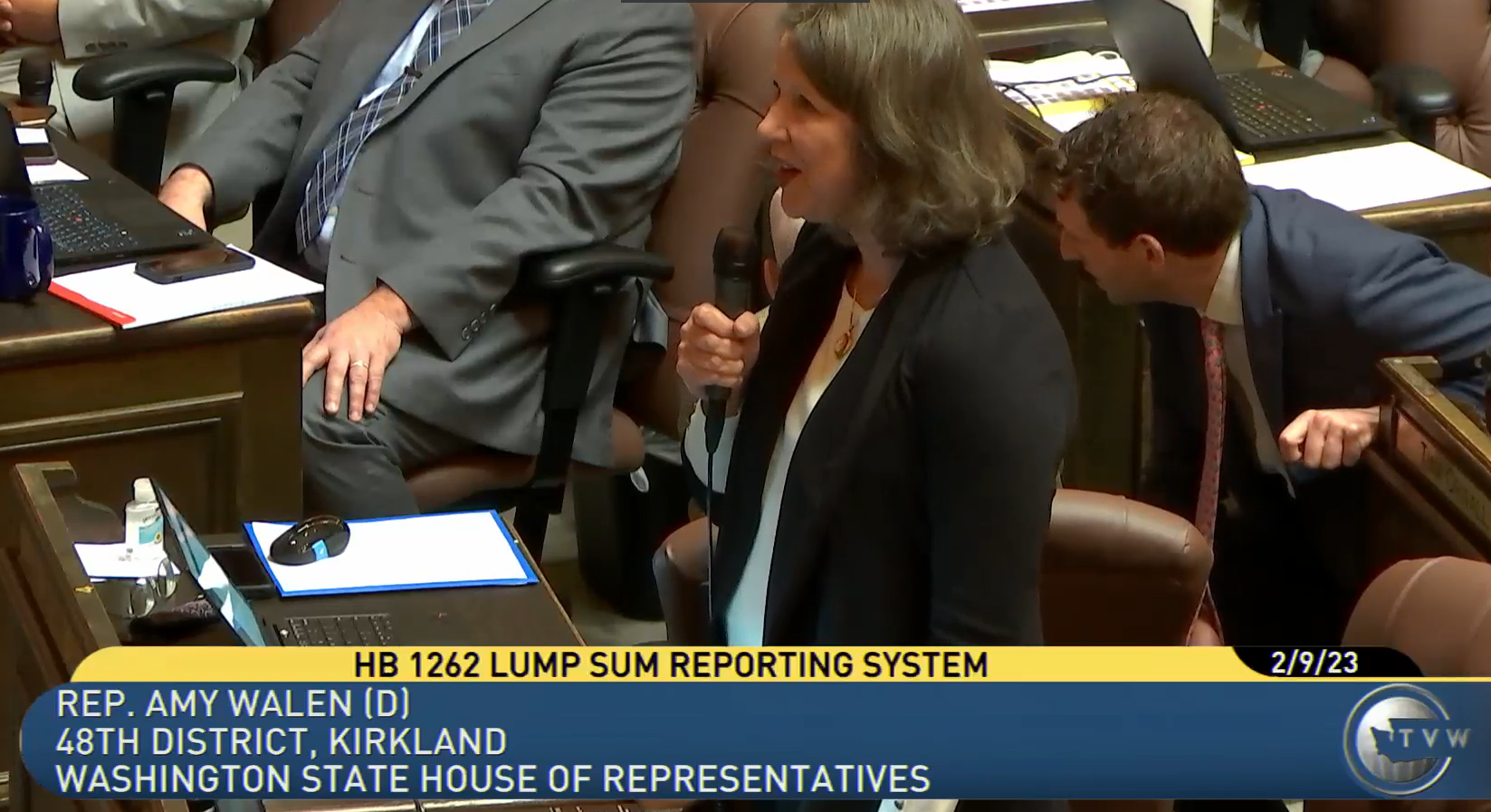

House Bill 1262 – Millions of dollars in back child support are due to the custodial parents. It is deeply unfair that those who can pay, do not. Currently, only a few employers voluntarily report bonuses and other lump sum payments. This bill will require employers to report lump sum payments only if an employee is already subject to an income withholding. On February 9th, this bill was passed off the House floor with a unanimous vote to the Senate Law & Justice Committee. You can view my speech by clicking here or on the image below!

Supporting Survivors of Domestic Violence

Supporting Survivors of Domestic Violence

In Washington, 20% of all murders are domestic violence offenses. Nearly 60% of intimate partner violence related homicides include firearms. This week, my colleagues in the Senate and House met to discuss the need for stronger protections, better services, and adequate funding for survivors of domestic violence. Below are some policies I am supporting this year to address this issue:

House Bill 1562 – Stalking, sexual assault, cyber harassment, and other tactics are used by abusers to perpetuate fear. This bill attempts to reduce the risk of lethality and harm associated with those likely to commit these crimes by governing the process of firearm possession and restoration of firearms rights. The law needs to be reflective of the risk of violence victims face.

House Bill 1715 – Domestic violence crimes are highly predictable and can be prevented. This bill builds a system to protect victims. From the creation of a hotline that performs a lethality assessment for domestic violence perpetrators, to increased access to counsel for low-income survivors and modifying the firearms surrendering process, we can better prevent victimization from occurring. Technology exists that can monitor offenders so that the victims of abuse can return home, rather than seeking shelter outside of their routine.

Each of us has been affected by domestic violence, but we may not always see it. I worked with a young man who was talented, funny and charming. He was deeply loved by our team. He is now in prison, and the mother of his child is dead. To hear that story and more on the work being done to help survivors, click here or on the image below.

Working Families Tax Credit

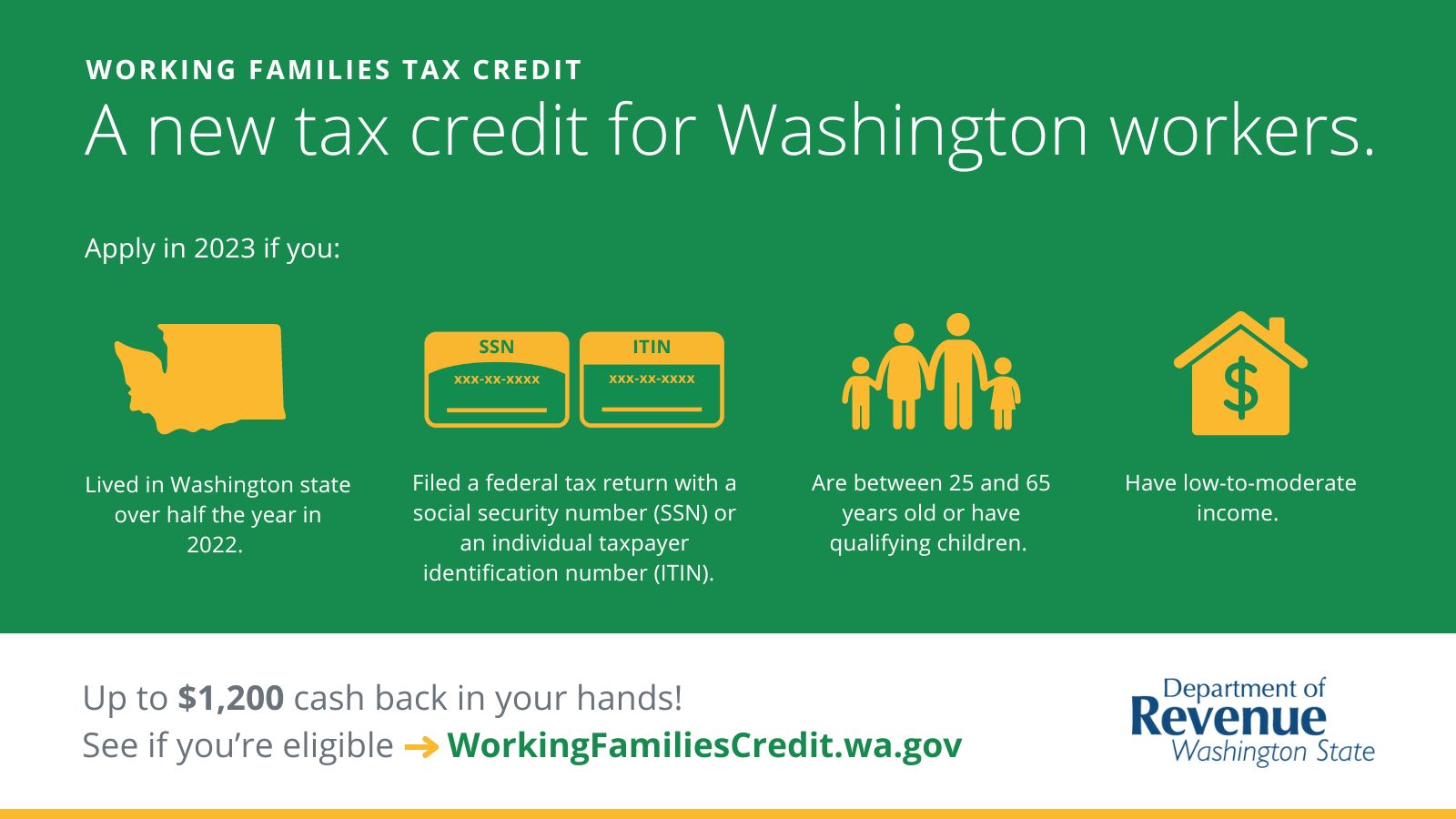

The Working Families Tax Credit is a new program that will provide payments of up to $1,200 to low-to-moderate income individuals and families. The amounts are based on income level and the number of qualifying children.

This program will help us stimulate local economies, promote racial equity, and provide the financial stability Washington families need right now. To find more information in several available languages, visit WorkingFamiliesCredit.wa.gov.

Let Me Know What Is Important To You

If you come down to Olympia, please schedule a time for us to meet so you can share your concerns with me. I am also happy to meet remotely if you are not quite comfortable in a public setting or simply don’t have time to make it to Olympia. My priority is hearing from you however you are most comfortable, whether remotely or in person.

If you have comments, questions, or ideas, please contact my office. I hope to hear from you soon!

In service,

State Representative Amy Walen

48th Legislative District