Dear friends and neighbors,

I hope this newsletter finds you in good health and good spirits! As we continue on the path toward reforming Washington’s tax code for the benefit of working families across the state, I wanted to share some of the progress we’ve made and the investments in our families and communities that we’ve been able to make as a result.

As many of you may know, Washington state has a history of having the most regressive tax code in the country. When I say “regressive” here, I mean that working families and low-income households pay a larger percentage of their income in taxes than wealthy households. However, we’ve recently made progress in addressing our unfair and unbalanced tax code through the enactment of initiatives like the capital gains excise tax, coupled with the expansion of the Working Families Tax Credit.

In fact, through the enactment of these two measures, Washington has moved from being 50th to the 49th most regressive state tax code in the nation. According to the Institute on Taxation and Economic Policy in their latest “Who Pays” Report: “… Washington was able to shed its title as the nation’s most regressive tax jurisdiction with enactment of a new tax on capital gains and the creation of a tax credit for low- and moderate-income families.”

Although we have made progress, we will need to continue to consider additional tax reforms to further prioritize working families, vulnerable populations, and essential services like affordable housing and poverty reduction. Despite this need for additional reforms, we should take a moment to celebrate what this progress means for Washington and how these tax reforms have already begun to benefit our state.

The Capital Gains Excise Tax

In 2021, the Legislature passed a Capital Gains Excise Tax (SB 5096), creating a 7% tax on the sale or exchange of long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets. The first $250,000 in capital gains annually is exempt from the tax, and it is designed to avoid taxing working families, so it also includes exemptions for all real estate, retirement accounts, livestock, agricultural land, fishing privileges, a qualified family-owned business, and more, meaning that most taxpayers in Washington state won’t ever pay this tax. In fact, according to the Department of Revenue, only 3,354 taxpayers (or less than 0.05% of all taxpayers) paid this tax for fiscal year 2023 –mainly the wealthiest in Washington.

This new tax is significant because it helps address the inequity of Washington’s working families paying almost four times more in taxes, as a share of their income, than the state’s highest income households – including some of the wealthiest individuals in the world. It’s also significant because the revenues from the tax are being invested in critical areas that help support Washington’s families and communities, including child care, early learning, K-12 education, and more.

Operating Budget Investments

The first $500 million in revenues from the Capital Gains Excise Tax is deposited into the Education Legacy Trust Account annually, and then any remainder is deposited into the Common School Construction Account for capital investment.

We can clearly see a significant increase in the investments being made from this account as a result of the Capital Gains Excise Tax. For example, based on the ERFC’s revenue forecast from February, around half of the dollars in the Education Legacy Trust Account for the ’23-’25 biennium come from the Capital Gains Excise Tax.

In the ’23-’25 biennium, the Education Legacy Trust Account was used to fund the following agencies and programs:

- The Department of Children, Youth, & Families ($386 million) – This includes funding for programs such as Working Connections Child Care ($240 million), the Early Childhood Education and Assistance Program ($96.5 million), and more early supports for families.

- The Office of the Superintendent of Public Instruction ($1.83 billion) – While school districts can choose what their funding pays for, these investments from the Education Legacy Trust Account for the 2024-2025 school year has been estimated to be able to fund basic education for about 83,328 students and special education funding for about 5,246 students. Or looked at another way, it could pay for approximately 7,156 staff (including about 4,552 teachers).

- Institutions of Higher Education ($378 million) – This includes funding for things such as salaries and wages, student financial aid, grants, and more at institutions throughout the state, including the University of Washington, Washington State University, Eastern Washington University, Central Washington University, The Evergreen State College, Western Washington University, and the Community and Technical College system.

Capital Budget Investments

In the ’23-’25 biennium, capital gains revenue made up about 75% of the nearly $600 million total funding in the Common School Construction Fund. That means that capital gains dollars made up nearly 10% of the total capital appropriations for the biennium, and over 60% of the biennial K-12 capital spending.

In the ’23-’25 biennium, Common School Construction Fund dollars were used to fund the following programs:

- School Construction Assistance Program – Funding for renovation and construction of educational space, open to all school districts.

- Small District Modernization – Grants for smaller (under $5m) projects in school districts with less than 1000 enrolled students.

- Career and Technical Education grants – Grants for CTE equipment and related expenses.

- School Seismic Safety grants – Grants for upgrades to school facilities, targeted to school districts with high risk of damage during earthquakes.

- Distressed Schools – Funding for emergent repair, renovation, and construction projects at public schools.

- Air Quality and Energy Efficiency – Funding for projects to improve air quality and reduce energy use.

The Working Families Tax Credit: Apply Today!

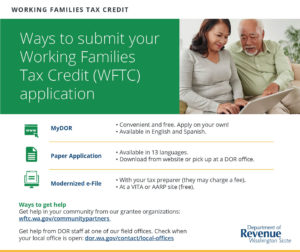

Don’t miss out, get more money back this year! You may qualify for a tax credit of up to $1,255 from the Working Families Tax Credit program. Visit wftc.wa.gov to learn more and apply.

Please Note: While this year’s deadline to file a tax return has passed, there’s still a lot of time to collect this year’s credit. In fact, you can even still collect 2022’s tax credit.

Thank your for taking the time to read this update! I appreciate your interest and engagement. Although the legislative session is over, our work for the People doesn’t end, so please don’t hesitate to reach out to my office to find a time to connect.