Dear friends and neighbors,

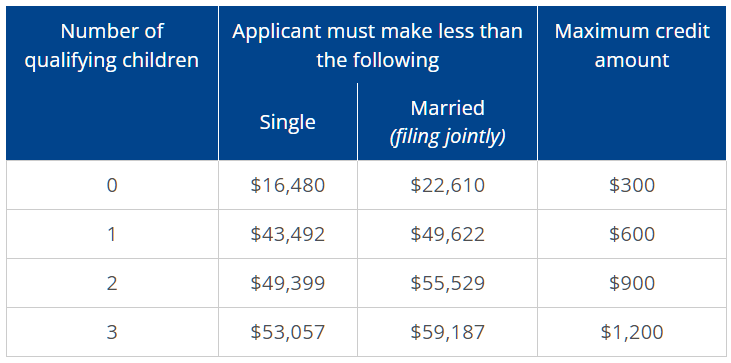

Working families deserve a break. I supported the creation of a program to give hard-working folks a state tax credit—and you could qualify for $300 to $1,200 a year.

The Working Families Tax Credit is a lot like the federal program, which is called the Earned Income Tax Credit.

If you qualify for the federal tax credit, you should qualify for the Washington state one, too.

Do you qualify?

It depends on how much you make and the number of qualifying children you have. Here’s the chart from the state Department of Revenue.

There are some other basic requirements: you need (1) a valid Social Security Number or taxpayer ID number, (2) to live in Washington state for at least half the year, (3) to have filed a federal tax return, and (4) to be between 25 and 65 years old.

Click here to see if you qualify.

How to apply

You can apply three ways: online, using tax software, or by mail.

Click on this link to apply online or find out more, including free resources and assistance if you need help.

Your family’s story

I’m interested in learning about your experience. The stories of people like you can help me argue for strengthening and expanding this program when we debate it in committee or on the floor of the House of Representatives.

I believe we should reward people who work hard to support their family. The Working Families Tax Credit is a great way to do that—and to make sure people living paycheck to paycheck have a little more in their pocket.

What’s your story? Please share it with me by email (dave.paul@leg.wa.gov) or the toll-free Hotline (800-562-6000). I look forward to hearing from you, and I hope anyone who might qualify takes a few minutes to check if their family could benefit from this!