Dear Friends and Neighbors,

We just finished the longest legislative session in state history. Our schools will have significant new funding, teachers will get a small cost of living increase for the first time in six years, and college tuition will go down. However, our tax system won’t be any fairer, and we didn’t take significant steps to reduce climate change due to Senate Republican opposition to every proposal championed by the House and Governor.

After 176 days of work, I wanted to let you know what my colleagues and I from the 46th District worked on for you, and how Olympia can do better. I always want to hear your feedback on how we can best represent our shared values and fight for what is important to you. Please don’t hesitate to contact me at any time!

Improved Investment in Our Children’s Schools for 2015-2017

The best news of the session is that we were able to invest $1.3 billion in our public schools, which is the largest increase in school funding in our state’s history. We made this investment despite the fact that the Tea Party-Controlled Senate Republican Caucus began with the goal of only funding half of what our kids need to succeed: smaller class sizes for all grades, all-day kindergarten, school building maintenance, supplies, and more.

What I heard loud and clear from parents and teachers, and what I fought for, is we must fully fund smaller class sizes for all grades, and not just up to the third grade.

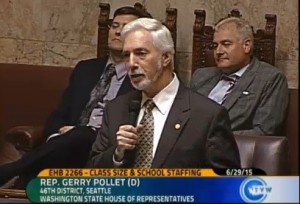

I was the sole speaker on the floor of the House against a four-year deferral of lower class sizes above third grade, which voters enacted with I-1351. I will continue to insist that our state develop and sustainably fund a plan to lower class sizes and properly pay our teachers. I worked to make sure hard-working teachers got a Cost of Living Adjustment (COLA), and we were able to add $157 million to that end. However, we need permanent, reliable funding to pay our teachers fairly, and to attract new teachers.

The way to do this is to make our tax system fairer by asking high income earners and corporations who benefit from having educated employees, to pitch in their fair share for public education and higher education. Our current tax system puts a much higher burden on hard-working families and retirees than our most well-off. I will continue to fight for fair taxes such as a tax on capital gains for corporations and people benefitting from large stock investments to fund public education, higher education, and vital support services to help people get back on their feet.

Three years ago, I sought the first state funding to reduce overcrowding and reopen school buildings, such as the Marshall School and Cedar Heights. I am very pleased to report that a united effort with other Seattle legislators resulted in the budget including at least $25 million to increase capacity for Seattle Public Schools to reduce overcrowding and encourage smaller class sizes, with additional funding for our Northshore and Shoreline schools.

As a member of the House Finance Committee, I worked throughout the session on proposals to close tax loopholes to make our tax system more fair and to provide the support we need for our children’s education and new investments in higher education. How is it fair that major agribusinesses processing food products in our state are exempt from paying state business taxes, while low-income earners in Washington are contributing nearly 17% of their earnings into the state?

But, while the final budget will close $452 million worth of loopholes, the Senate Republicans insisted on adding new ones and extending loopholes that would have expired. Extending tax breaks for agribusiness and continuing big oil’s loopholes deprived us of funds needed for our teacher’s health care, lower class sizes, and increased financial aid for college students.

One Supreme Court Justice has already suggested that the Court might void all tax loopholes if we don’t meet our duty to provide the funding needed for our children’s constitutional right to a basic education. The Senate Republican’s insistence on giving away more tax breaks is likely to be a factor in the Court’s next decision.

Historic Investment in Higher Education and Affordable Tuition

This year, Washington state became the first in the nation to cut tuition for college students. After decades of disinvestment and tuition doubling for students between their freshman and senior year, we have turned the tide.

For the 2015-2016 school year, all students in public universities and community colleges will have a 5% tuition reduction. In the 2016-17 school year, students at UW and WSU will receive a 10% reduction, and students at our regional universities will have a 15% tuition reduction. The House Democrats fought hard to make sure that these cuts to tuition were fully funded with the closure of outdated tax loopholes, and that community college students also received a cut to their tuition.

Ever since I was elected, I have focused on making sure that higher education is affordable to the average family, and that income, geographic location, race, and circumstance would not be a barrier to accessing higher education. I have introduced legislation to cap tuition at no more than 10% of median household income, and to require that the state fund any reductions in tuition. This formula is part of the legislation adopted to lower tuition, and I am proud that we could get part of the way there. Even with all of this historic investment, there are still over 33,000 students who – even with this new funding – are still eligible for state financial aid but don’t receive it. Our work is not finished.

For families who invested in GET to have security to pay for tuition, I will continue to work to ensure that you don’t lose value, while we preserve the fiscal integrity of this excellent pre-paid tuition program.

Protecting Vulnerable Students from Isolation & Restraint

I am incredibly grateful to the parents and advocates for people with disabilities who helped pass House Bill 1240, which would put an end to the planned use of restraint and isolation for students in public schools, which especially affects students with special needs.

It’s estimated that 150 students die in our nation’s public schools every year from inappropriate use of isolation and restraints! With passage of HB 1240, our students in Washington will not be part of that statistic.

This bill ends the planned use of restraint and isolation as a part of the individualized education plans created for students with special needs. HB 1240 extends the prohibition against restraint and isolation to all students, except in very limited circumstances where spontaneous behavior creates an imminent risk of harm.

We had learned that restraints and isolation in schools posed significant risk of injury, and even death for these students. Many reported PTSD, and their mental well-being, behavior, and educational outcomes suffered. Although the law has passed there is still more work we should do to make sure the law is interpreted and enforced correctly.

Transportation Revenue and Climate Change

Although there were some tough compromises to make on transportation this year, the 46th District is very well-served by this biennium’s transportation budget.

We were able to get $10 million for the Northgate Pedestrian Bridge to connect North Seattle College to the Transit Center, $16 million for Burke-Gilman Trail transit access, safety, and efficiency improvements, $12 million to improve 522 – Bothell Way in Kenmore, $8 million to repair the deteriorating Sammamish River Bridge in Kenmore (which would fall in a significant earthquake), and $875,000 to make the Lyon Creek Culvert in Lake Forest Park more friendly for salmon. As a state, we also invested millions to fund Safe Routes to School, particularly sidewalks that our kids need, especially in light of pedestrian deaths in Kenmore and near Eckstein Middle School.

My first choice would have been to fund this through a carbon polluter’s tax, and a cap on carbon emissions. Unfortunately, the Tea Party Republicans who control the Senate have their heads in the sand about climate change, refused to negotiate on this and only would pass this historic investment in transportation if it did not include a clean fuel standard. I will continue to fight for a clean fuel standard next session.

Mental Health and Vital Social Services

Everyone deserves to live somewhere safe, and should be able to get the care they need to stay healthy. After years of cuts to mental health and psychiatric care, we were able to give $100 million to back-fill those cuts to make sure that people get the care they need. We were also able to restore the recession-era cuts to TANF, and $11 million to state food assistance. This is not enough, but it is an important step in the right direction.

E-Cigarettes: Working to Prevent a New Generation From Being Addicted to Nicotine with the First Proposed Comprehensive Regulation in the Nation

One in four of our high school seniors used e-cigarettes and “vape” products last year! The big tobacco companies and others are addicting a new generation to tobacco and selling vaping products for use with drug oils to our kids. I’ve gone around the 46th District and seen first-hand how easy it is for our kids to buy these unregulated products.

Working with colleagues from the UW School of Public Health, and local public health officials, we developed the first bill in the nation to regulate sales of e-cigarettes, disclose the toxic ingredients and levels of nicotine, and to prevent marketing and sales to youth. Governor Inslee and Attorney General Bob Ferguson proposed this “request” legislation and continue to make passage a priority.

The bill was supported by the state Department of Health, pediatricians, public health experts, the federal CDC, and many health advocacy organizations across the state. They and I agree that as adults, we have a shared responsibility to make sure that the next generation does not become addicted to nicotine. We were proud to work with students and faculty at the UW School of Public Health to conduct extensive research on the contents and effects of e-cigarettes on youth and adults.

The bill was supported by the state Department of Health, pediatricians, public health experts, the federal CDC, and many health advocacy organizations across the state. They and I agree that as adults, we have a shared responsibility to make sure that the next generation does not become addicted to nicotine. We were proud to work with students and faculty at the UW School of Public Health to conduct extensive research on the contents and effects of e-cigarettes on youth and adults.

This bill would have taxed the nicotine in e-cigarettes at a rate lower than traditional cigarettes, required the disclosure of ingredients, outlined rules for retailers to prevent sales to youth, and child-proof packaging to prevent young children from risking nicotine poisoning. Big Tobacco fought this bill every step of the way. The bill made it through committees and was part of the final budget discussions – but the Senate refused to consider regulating and increasing the price of e-cigarettes. Although we did not pass it this year, we succeeded in educating legislators, stakeholders, and the public about the urgent need to prevent sky-rocketing teen use and addiction.

Thank you for taking the time to read this newsletter. It’s almost as long as this year’s legislative session!

I continue monthly drop-in coffees and am available to meet with groups, please check my Facebook page for locations or, email me to ask at gerry.pollet@leg.wa.gov. Please don’t hesitate to contact me about issues you are concerned about, or if there is anything I can help with.