Friends and neighbors,

We’ve crossed the one-quarter mark in this legislative session, and I’m excited to share with you some of the important work we’re doing at the Capitol to build a stronger, more equitable future for all.

Investing in Working Families:

One of my top priorities this session has been expanding the Working Families Tax Credit. This vital program provides much-needed relief to middle-class families struggling to make ends meet. This year, I’ve introduced House Bill 1075 proposing to:

- Extend the credit to young adults aged 18-24 who are entering the workforce or pursuing higher education. This critical stage often comes with significant financial burdens, and the tax credit can lighten the load and promote upward mobility.

- Increase the credit for seniors on fixed incomes. Rising costs, particularly of healthcare and essentials, disproportionately impact our older adults. Expanding the credit will help ensure their financial security and well-being.

Streamlining Eligibility:

To ensure the effectiveness of the Working Families Tax Credit, I’ve also introducing House Bill 1895 that allows the Department of Revenue to utilize automated verification tools.

This will:

- Reduce errors by automatically verifying income and other eligibility criteria.

- Simplify the application process for taxpayers, making it faster and easier to claim their deserved benefit.

- Direct more resources towards essential program services and outreach.

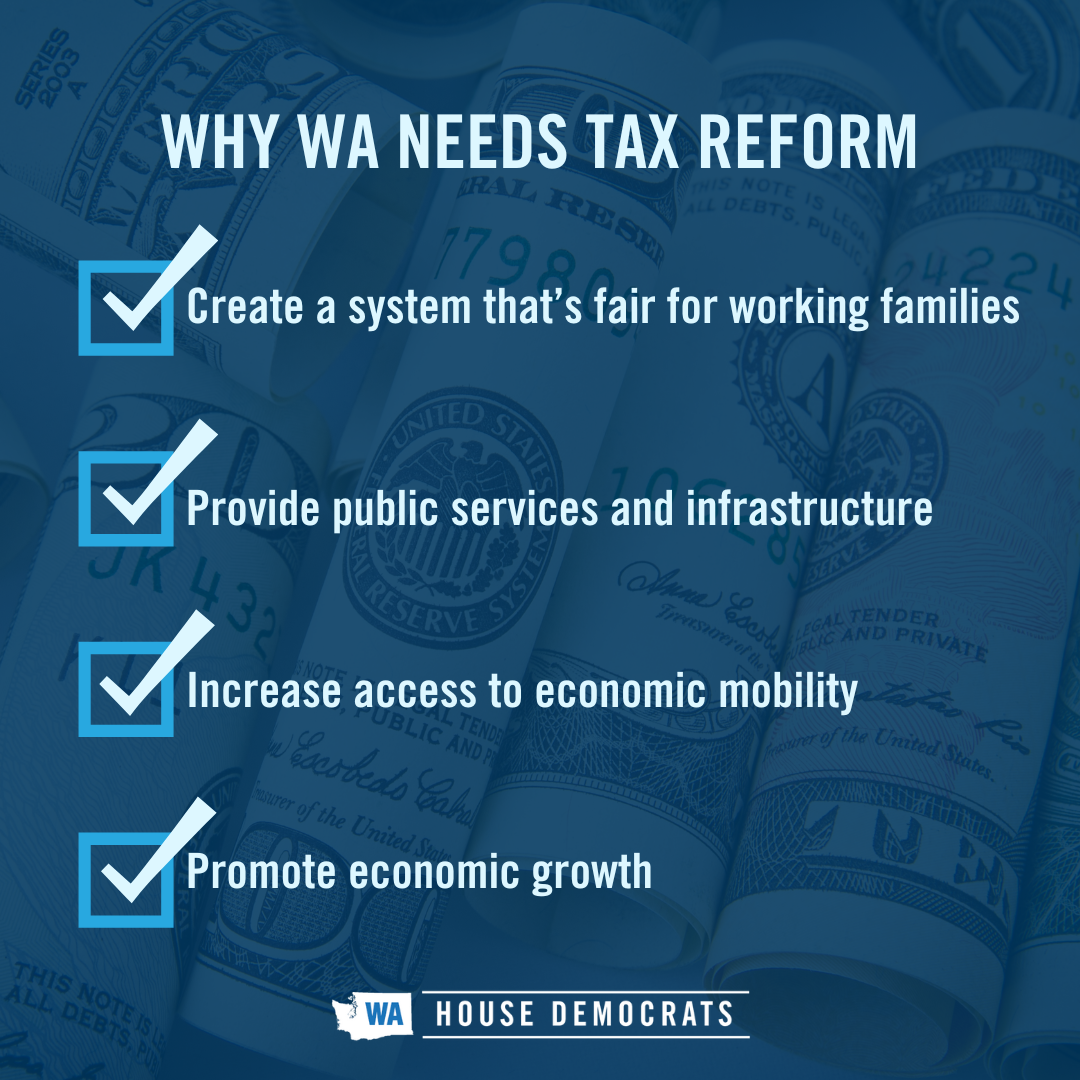

Building a Fairer Tax System:

Expanding the Working Families Tax Credit and combating fraud are just two steps towards a broader goal: achieving true tax justice in our state. We need to move away from a regressive system that disproportionately burdens low- and middle-income earners. Instead, we should prioritize equitable and progressive taxation that asks the most from those who can afford it, while investing in those who need it most.

In the coming weeks, I’ll be working tirelessly to advance common-sense policies like a capital gains tax (HB 2278) and wealth tax (HB 1473) that ensure our tax system supports working families, promotes economic opportunity, and strengthens our communities. Many of these policies are based off the work of the Tax Structure Work Group’s (TSWG) final report highlighting how the Legislature can create a more equitable, transparent, and stable tax code for working families and small businesses across the state.

Together, we can build a brighter future where everyone has a fair shot at success. To learn more about Washington’s tax system become more fair, read my recent press release here.

Get Involved

- Visit my website.

- Join my email list.

- Follow me on Facebook.

- Email me.

Thank you for your continued support. I look forward to hearing from you and working together to create a more just and equitable future for all.

Sincerely,

Rep. My-Linh Thai

41st Legislative District