Dear friends and neighbors,

As we enter April, the 2025 legislative session is set to adjourn in 19-days. I want to share an update on key milestones and what’s ahead in the final weeks.

Proposed Revenue Options

Over the past two weeks, we released our 2025-2027 operating, transportation, and capital construction budgets. These proposals take a balanced approach, protecting vital services while addressing economic challenges. People across our state rely on essential programs like education, healthcare, childcare, transit, and food assistance. As a member of the House Appropriations Committee, I am committed to ensuring these investments remain strong, even as we navigate a slowing economy and federal policy changes.

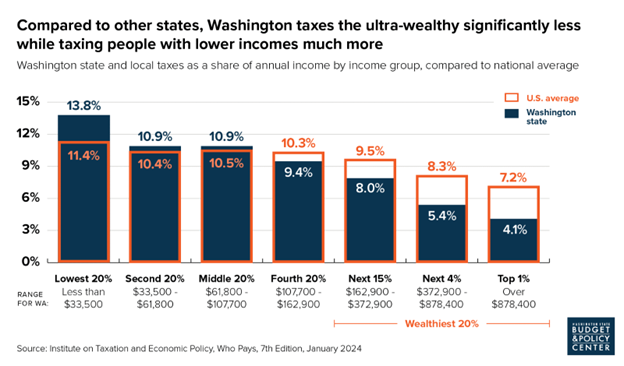

A fair tax system is key to funding these priorities without placing the burden on working families. That’s why I have long supported progressive revenue reforms, including the Working Families Tax Credit, the Capital Gains Tax to fund early learning and childcare, and a wealth tax to ensure the top 0.05% contribute their fair share. Our tax system has historically asked the most from those who have the least, while allowing the wealthiest to contribute far less. By modernizing the way we generate revenue, we can build an economy that works for everyone—not just those at the top.

Several progressive revenue policies are currently under consideration to fund critical services. One proposal is the Financial Intangible Assets Tax, which would apply to stocks and bonds owned by the ultra-wealthy, exempting the first $50 million in assets. This would generate $2 billion annually for K-12 education, ensuring that financial wealth is taxed fairly, just as homeowners already pay property taxes on their homes.

Another measure would adjust property tax growth limits to 3% from 1% to better reflect inflation and population changes, ensuring rural schools receive fair funding and raising $50 million in 2026 and $150 million in 2027. Additionally, a surcharge on corporations making over $250 million annually would raise nearly $2 billion by 2027, ensuring that the largest businesses contribute to the services that help our communities thrive.

To learn more about work to tackle the budget deficit and call for reform in our state tax code, click here or on the image above.

Capital Budget Update

The capital construction budget includes $4.6 billion in new investments across Washington. In our district, this means funding for community infrastructure, housing, behavioral health facilities, and schools.

The capital construction budget includes $4.6 billion in new investments across Washington. In our district, this means funding for community infrastructure, housing, behavioral health facilities, and schools.

Local investments include $1.5 million for Puget Sound Regional Archives HVAC improvements, $2 million for the IACS Kent Community Center, $1 million for affordable housing at Orchard Gardens, and over $5 million in facility and infrastructure improvements at Bellevue College.

The budget also sets aside larger-than-usual reserves to prepare for economic uncertainties stemming from federal policies and rising material costs.

Video Update

In my latest video update, I sat down with Rep. Lisa Parshley to discuss our legislative priorities and the policies we would enact immediately if given the chance. This was a great opportunity to highlight the direction we want the legislature to move in and how we can continue supporting communities across our state.

What’s Next?

In the coming weeks, House and Senate negotiators will finalize budget compromises. Once these are passed, I will report back on what they mean for our families, neighborhoods, and local infrastructure projects. If you have any questions or thoughts on the legislative session, I encourage you to reach out. I look forward to sharing more soon.

In Service,

Rep. My-Linh Thai