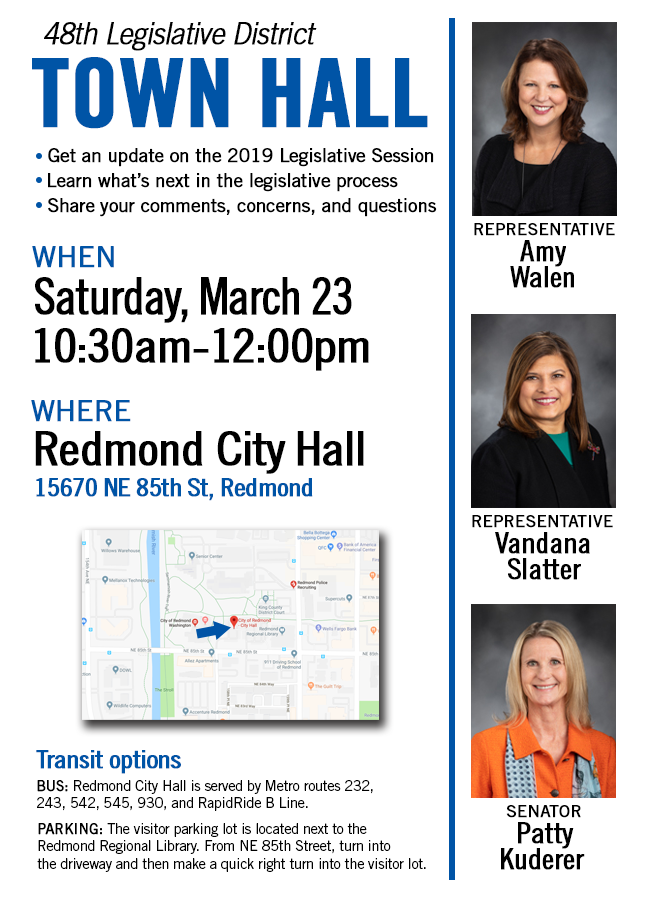

Town Hall announcement

Who I am, and what I’m about

I recently recorded a podcast about my first few weeks as a new legislator. Click the image below to listen and learn about my values and what I’m doing to improve our communities.

Improving Health in Our State

Last week, the Washington House of Representatives passed significant legislation that will improve the health and wellbeing of people at all life stages in our state.

House Bill 1074 will raise the age of sale for all tobacco and vaping products from 18 to 21. This legislation will save lives from easily preventable deaths and protect youth from lifetime addiction. Tobacco is the leading cause of preventable disease and death in our state, killing more than 8,300 Washingtonians each year. The use of electronic cigarettes has become an epidemic among youth in our country, with 8 percent of high school smoking cigarettes and 21 percent using electronic cigarettes. I am proud to be a co-sponsor of this bill.

The Long-Term Care Trust Act (House Bill 1087) also passed the House last week. Our plan will provide people with support they need to live independently as they age, including help with personal care, medical assistance, transportation, meals, and more. Caring for a loved one comes at a cost for families, and with 70 percent of Washingtonians over the age of 65 requiring some form of long-term support services, it is imperative that we are prepared to pay for care as we age. The Long Term Care Trust Act would create a public insurance program and prevent people from spending down their assets to qualify for Medicaid.

I was proud to vote in support of both of these bills and am hopeful that they will pass through the Senate Chamber and be signed into law by the Governor.

Fiscal Week Cutoff

I have spent several hours each morning in the House Finance Committee hearing bills related to flexibility of funds to be used for affordable housing, supporting veterans, and rebalancing our regressive tax structure. We faced a deadline of Thursday to advance bills with a fiscal impact, otherwise they likely won’t progress through the legislative process.

I am proud to be a co-sponsor of House Bill 2117 which will provide a pathway to modernize and transform the Washington state tax structure so that it is equitable, adequate, stable, and transparent for the people of Washington State. This plan is the first of its kind to tackle our tax code in an ambitious and large-scale way, incorporating feedback from constituents and businesses all across the state. The bill would continue the work that was begun in earnest with the bi-partisan state-wide listening tour that members of the Tax Structure Work Group embarked on last year. HB 2117 would reauthorize the Tax Structure Work Group for another two years, expand its voting members to nine people, and authorize the creation of technical advisory groups that would include a broad range of participants, including Washington residents, the business community, academics, and tax law practitioners. HB 2117 passed out of the House Finance Committee this week and will be referred to the Appropriations Committee.

The Finance Committee will also be considering an excise tax on the sale of capital gains, and I look forward to sharing details of those discussions as they emerge.