Friends and Neighbors,

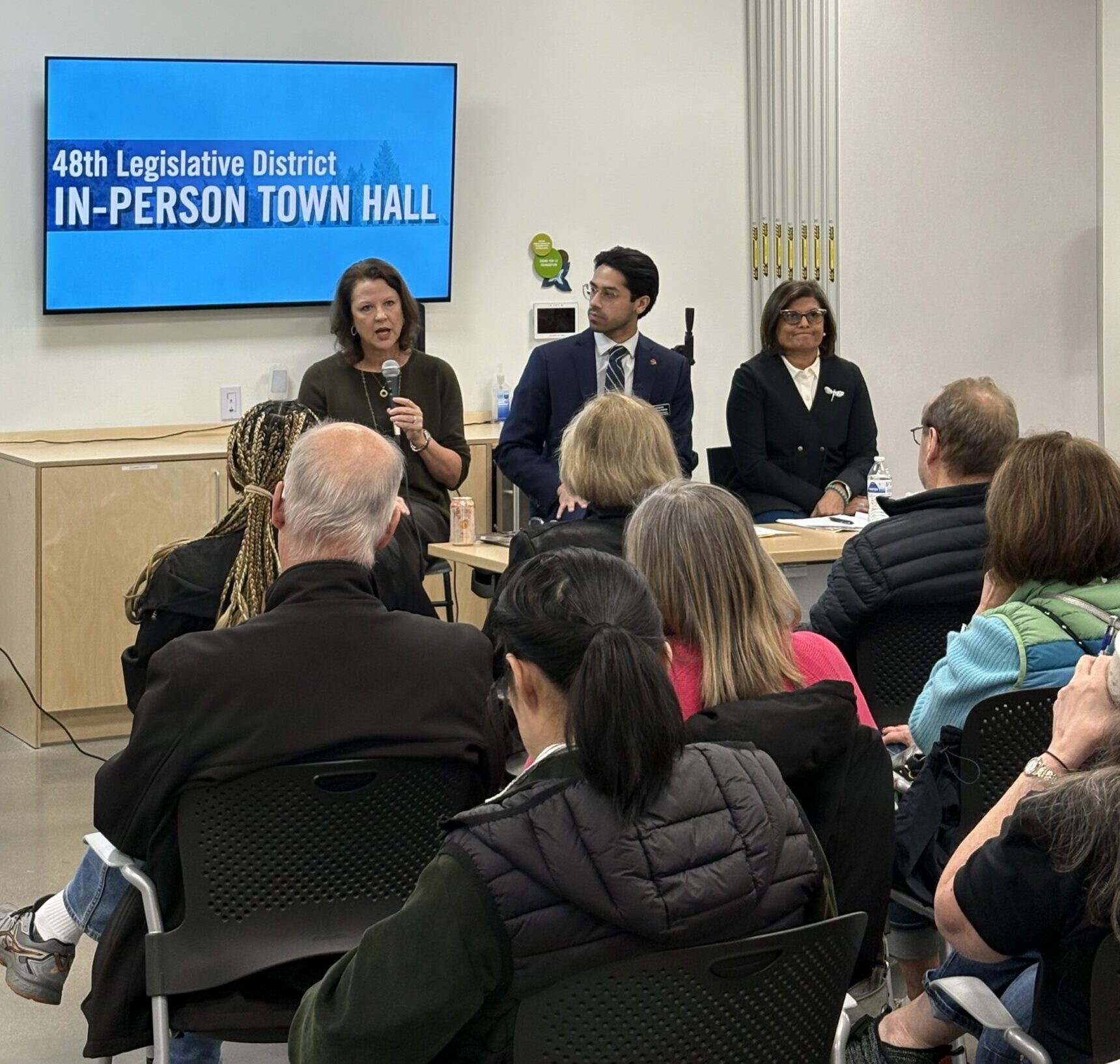

Before I get into the latest on what’s happening in Olympia, I want to quickly thank all of you that joined me, Rep. Osman Salahuddin and Sen. Vandana Slatter at our recent town hall. It was fantastic to see so many people turnout and to hear your concerns. We received many thoughtful questions that sparked important conversations about the issues that matter most to our community.

Your voices help shape my work in Olympia, and I look forward to continuing the conversation. If you couldn’t make it, my door is always open — learn more about how to get in touch with my office here.

About the budget …

Many of you asked about the state’s budget, and how we’re going to balance it. Over the past year, I’m sure you’ve heard about Washington’s budget challenge, and you may have seen recent news reporting about the various proposals for solving it. I wanted to take some time here to talk more about that.

Here are my guiding principles on the budget and recent tax proposals:

Protect the most vulnerable: Children, seniors, disabled folks, animals, immigrants.

- Do no harm to cost of living for working families. We must listen to you, our constituents, who are being squeezed from every direction financially. Our current proposals increase the cost of property, food, fuel, family vacations, miles traveled, prescriptions, health care premiums, cell phones, social media and streaming services, hunting fishing and camping permits, concert and sports tickets, rental cars, vehicle purchases, soda, beer and wine. We cannot balance our budget in this way.

- Do no harm to our state’s competitiveness nationally and globally. We already know that the tech companies in our state are mobile. We saw 25,000 Amazon team members being moved from Seattle to Bellevue to minimize the impact of the ‘Jumpstart Tax.’ These aren’t brick and mortar companies that would incur a significant expense to move – they can move their HQs anywhere. Our current budget proposals seem designed to encourage HQ’d businesses in Washington to relocate to Wyoming, Nevada, Delaware, or Georgia – states that will pay them per job to move. This sort of budget policy endangers our economy.

- Do not dampen the innovative economy that built the prosperity we all rely on. The vibrancy of our communities depends on the business ecosystem. Corporations need to pay their “fair share” AND, at the same time, we can’t be so punitive in our tax structure or so unpredictable in our policy making that we pose a risk to long term investment. We have to carefully balance the budget in order to provide relief to Washington families without harming business. These are not mutually exclusive, and I know a healthy balance can be struck.

Discourage investments that don’t solve our housing affordability crisis.

In terms of taxes, we need to preserve our taxing capacity in case we need it later due to unprecedented federal actions or responses to tariff impacts. That means we should hold off on any policies that would:

- Increase prices on fuel and food for working families now

- Jeopardize local hospital services by cutting their rates and adding cost burdens on top of that through our revenue proposals

- Cut our budget for PEBB/SEBB by shifting costs to the private sector which will take the form of significant health premiums for working families

New taxes are an almost last resort and should only be imposed when absolutely necessary. While the current outlook is difficult and uncertain, I do not believe we are there yet.

There is no doubt this is a challenging budget situation. But it’s important that we move forward in a fiscally responsible manner that protects Washington’s future, it’s economy, and preserves the quality of life we have built here thanks to the hard work and ingenuity of our residents and businesses, and appropriate, balanced policy.

Here’s the latest on my bills

Several of my bills are under consideration in the Senate, making their way through the legislative process. Here’s what’s still in play:

House Bill 1576 standardizes the process of historic designation statewide, removing the potential for abuse of the process to prevent housing development. Preserving our historic landmarks is important to maintaining the character and beautiful history of our neighborhoods and communities. We also know that many of our neighbors are desperately struggling to find and afford housing. This bill will ensure that the process used to preserve our neighborhoods’ histories are not being abused in order to prevent our neighbors from finding affordable housing.

House Bill 1094 provides a property tax exemption for property owned by certain nonprofit organizations that is rented and used by a government entity to provide certain social services. This bill will be a significant boost to the good work happening at places like the Together Center in Redmond by easing the financial burden. Many areas are currently facing behavioral health crises, this bill will support those doing the important work to manage them. I am happy to share this bill has already passed both the House and the Senate.

House Bill 1757 makes it easier to convert existing buildings into homes. This bill builds on my previous legislation to allow the conversion of existing commercial properties into housing. Currently, the rules only apply to conversions in commercial mixed-use zones. HB 1757 will extend these allowances to commercial buildings in primarily residential zones, a significant step toward increasing the housing supply we desperately need to address our housing crisis.

We are rapidly hurtling toward Sine Die (the last day of the session). I look forward to updating you on where these policies ultimately land.

Keep an eye out for my next legislative update and as always, please reach out with thoughts, ideas, questions or concerns.

Thank you,

![]()

Rep. Amy Walen