Dear friends and neighbors,

As many of our families and businesses continue struggling, governments at the local, state, and federal levels are coordinating to get every person who wants a vaccine vaccinated quickly so we can all go back to normal sooner than later.

But we are still experiencing shortages and shipments we were counting on were delayed due to the snowstorm we got last week. I realize this may sound trite but, to get through this, we all need to practice patience and kindness, and we all need to continue masking up even after we get the vaccine. This has to be a collective effort to succeed.

A year ago, during the first part of the pandemic, the legislature acted in a bipartisan manner to prepare for the financial impact before we adjourned last March.

This session we’ve already passed unemployment insurance tax relief for businesses, increased benefits for the hardest hit workers, and approved an early action $2.2 Billion package to address our most immediate needs. Now we have to focus on writing the 2-year budget, which brings me to the main topic I want to address in this newsletter: our shameful tax model.

Most regressive tax system in the Nation

While it’s true that the initial hit to our state revenues was not as severe as expected, it’s also true that there will be gaps to fill. We won’t know just how deep those gaps are until we see our revenue forecast, which won’t be available until later in the session. As you can see, there’s still much uncertainty, however, one thing we know for sure is that we can’t continue doing business as usual with an upside-down tax structure.

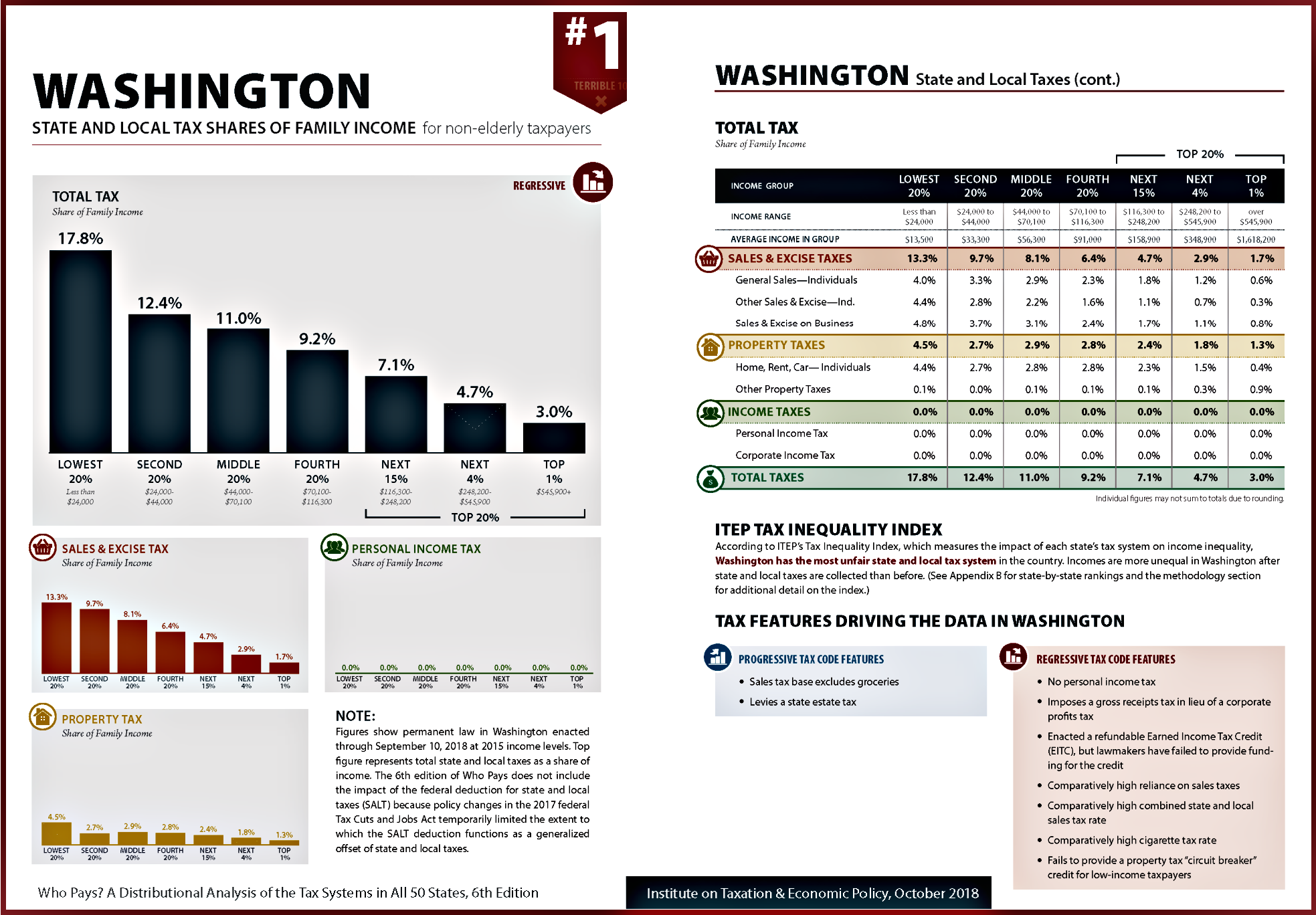

Our state’s tax code is the most regressive in the entire country. This means that the imbalance in overall tax rates faced by low-income families versus high-income is larger in Washington than in any other state. These charts, borrowed from the “Who Pays? 2018 Report” by the Institute of Taxation & Economic Policy, show the striking and unfair reality of our tax system.

For a larger PDF version, please click here or on the image below.

Can billionaire$ afford to contribute more fairly?

Middle-class Washington families pay a larger share of our income. As you can see in the charts above, we pay four times more in taxes than the highest-income households do.

In other words, it’s folks like you and me – rather than the wealthiest among us – who are picking up most of the tab for funding schools, safety programs, and homelessness services. For the lowest-income households – those making $24,000 or less per year, it is even worse, as they pay six times more in taxes as a share of their income. That’s why I am supporting HB 1406, which could make things a little better for Washington’s working families. Instead of continuing to rely on sales tax and tax on real property for the majority of our state’s revenue, it makes sense to tax the financial assets billionaires use to make their fortunes at one percent. It would exempt the first $1 billion of wealth, making the tax barely a blip on the radar for someone who makes billions in a single year. If your net worth doesn’t add up to more than a billion dollars, you won’t be paying this wealth tax. Our state cannot continue to over-rely on low- and middle-income families to pay for the vital programs and services our communities need. It’s time to start asking the wealthiest Washingtonians to contribute proportionally, like the rest of us do. |

Funding childcare with a Capital Gains Tax

The COVID-19 pandemic has highlighted the critical importance of childcare for working families and the business community.

To bolster economic recovery and the well-being of working families, I am supporting HB 1496, aimed at funding the expansion and affordability of childcare through a capital gains tax. This measure will also help address the systemic inequities in our tax code, since, as I wrote earlier, Washington has the most regressive tax structure in the nation. A capital gains tax would help ensure the wealthiest Washingtonians share in the responsibility of funding key programs and services, such as the much-needed investment in childcare. This legislation will help kickstart our economy, provide resources to invest back into our communities, help rebalance our upside-down tax code, and give kids across our state a fair start. Additional details, including tax rates and exemptions, are available in this recent press release. |

The Transportation Package: how we got here

In my previous newsletter, I included a video and told you about the meetings we held with stakeholders around the state to write our transportation proposal. Now I’d like to share some of the key elements that went into the process of developing this package:

All of the budget work will be negotiated over the next weeks and won’t be finalized until agreement is reached and revenue forecasts are available. |

Watch my Videos

Lastly, I invite you to watch my latest Ask SHARON video on lead in school water & support for victims of sexual assault, as well as my Video Update on cutoffs and broadband in transportation projects.

|

Thank you for reading my newsletter. If you need more information on any of the issues discussed here, or on any other legislative matter, please don’t hesitate to contact my office.

And please check out my official Facebook page.

Sincerely,