Dear friends and neighbors,

Thank you to everyone who came to our town hall meeting last Saturday at the Eastside Community Center in Tacoma. These meetings are one of several ways I stay engaged with constituents in person throughout the year. We had a strong turnout as usual, but if you couldn’t be there you’ll have other opportunities to meet with me and ask questions about legislative issues. After the legislative session, I always hold several “community conversations” around the district, which are smaller, less structured gatherings where you can show up and share your thoughts. Look for dates and times of these events in an upcoming e-newsletter.

You’ll find some highlights of the town hall below. If you haven’t already, you may want to like or follow my official Representative Laurie Jinkins Facebook page, where I post regularly about my legislative work and provide a behind-the-scenes look at the day-to-day happenings in our state capitol. Announcements of upcoming meetings and events are also posted there.

Finally, the House unveiled its budget proposal for our state this week and I’m pretty excited about it. Not only does it make smart investments in areas of critical need, like education, housing and behavioral health, but it pays for these investments with a revenue package that brings more balance to our state’s regressive tax code. This is something I’ve been pushing for since I first came to the Legislature. The wealthiest Washingtonians should have to chip in to fund the needs of our state just like working and middle class families already do.

Sincerely,

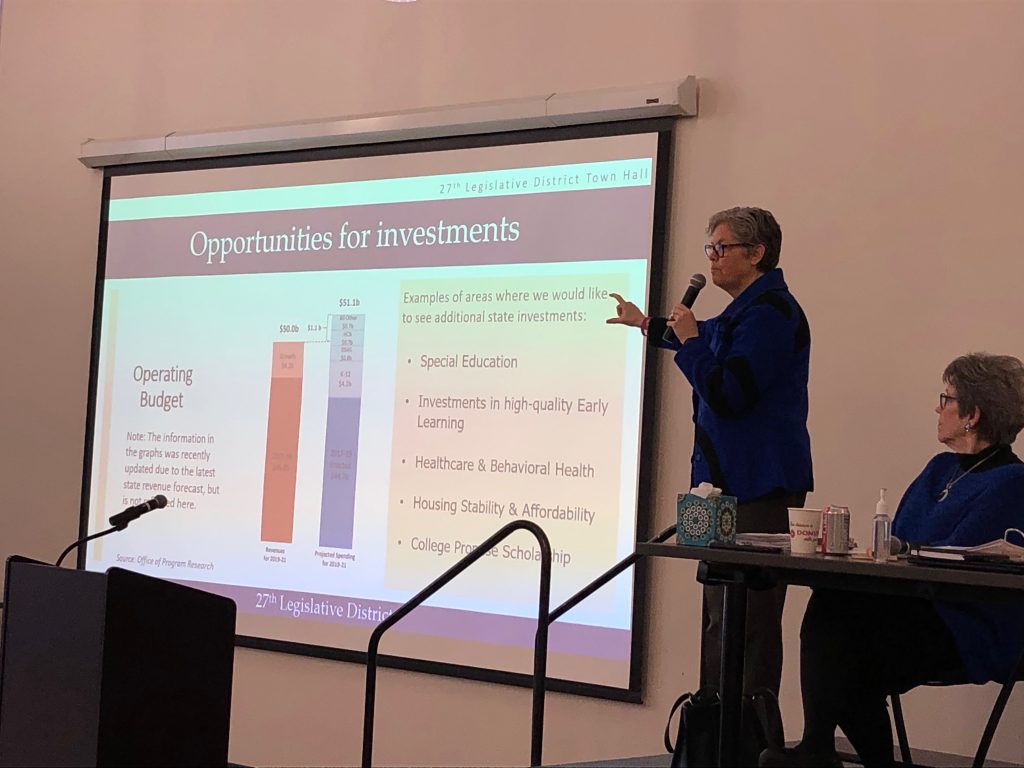

The state budget: Opportunities for investments

At the town hall meeting, I spoke about where things currently stand with our state budget. While we got some good news last week in the form of a positive revenue forecast, this alone is not enough to pay for critical investments in areas like more beds for behavioral health treatment and housing programs to help address the homelessness crisis.

Here’s why. The state budgets on two-year cycles, and we’re nearing the end of the current cycle. If we simply carry forward the current budget, with zero new investments or increases to anything, we would have been looking at a shortfall of over a billion dollars.

How can that be? Because our population has increased over the past two years, and the cost of providing services goes up like everything else. The same dollars today don’t buy as much as they did two years ago. Additionally, when the legislature finally satisfied the constitutional obligation to fully fund our K-12 schools (the “McCleary decision”), it committed to billions of dollars more for education. Thanks to that positive revenue forecast, though, we don’t have a billion-dollar shortfall.

That doesn’t mean our state doesn’t have some very critical needs. During the Great Recession, deep cuts were made to our state budget, impacting people and families. We have still not restored many of those cuts to pre-recession levels, even as our economy recovered. Additionally, we need to do more in special education, and in addressing levy equalization for school districts.

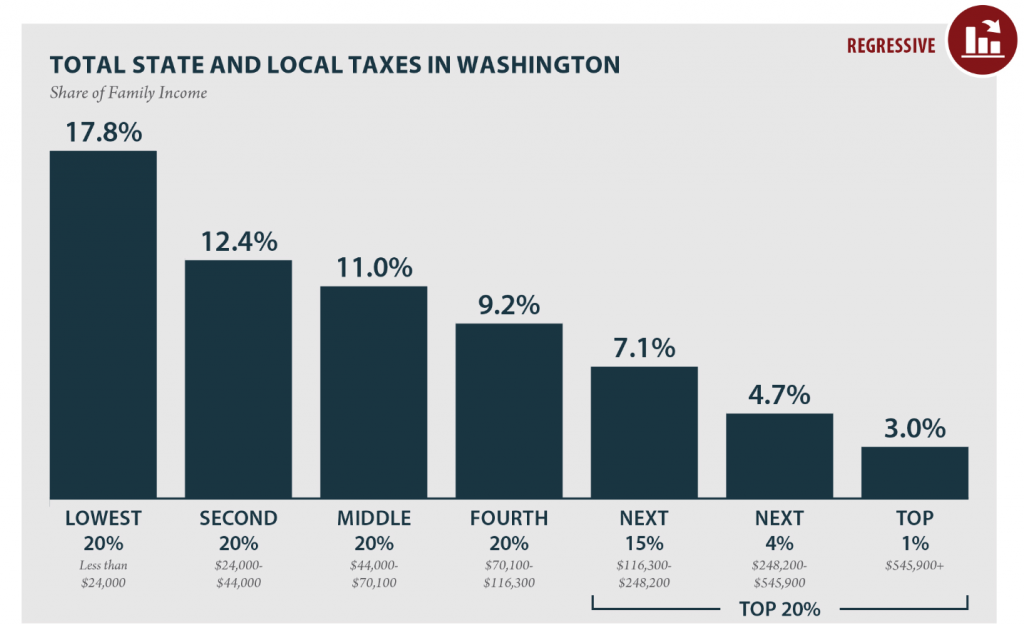

Who pays for state investments?

Our state’s regressive tax system (the most regressive in the nation, according to the non-profit, non-partisan Institute on Taxation and Economic Policy) means that average taxpayers carry the bulk of the tax burden. I don’t think it’s right to ask hard-working families or our seniors – many of whom are living paycheck to paycheck or are on fixed incomes – to pay more in sales or property taxes when the wealthiest Washingtonians pay far less of their incomes in taxes. The chart above shows the stark difference in what people in our state at different income levels pay in terms of taxes as a percentage of income.

That’s why I strongly support the House’s revenue proposal that was released on Monday. It simply asks the wealthiest people in our state to contribute to these critical investments like behavioral health, housing, and education. Through an extraordinary profits tax and a progressive real estate excise tax, our tax system will be more balanced and not tilted so heavily against working families.

Extraordinary Profits Tax

I call this the “You’ll-Never-Have-To-Pay-This Tax,” because it would affect less than 0.5% of households statewide. If you are one of those households, congratulations. You are doing extremely well.

The proposed tax would be a 9.9% excise tax on the sale of high-value assets like stocks and bonds, if the profit from the sale is $100K or more for single filers ($200K or more for married filers). Here’s what is NOT subject to the Extraordinary Profits Tax: retirement accounts (IRAs, 401Ks); sales of single-family homes, duplexes or triplexes; sale of agricultural land or timber land; sale of cattle, horses or breeding livestock; sale of certain qualifying small businesses.

Progressive Real Estate Excise Tax

Washington currently has a flat real estate excise tax of 1.28%. Everyone pays that same rate – whether you sell your home for $200,000 or for $2 million. A graduated rate structure provides an opportunity to actually lower the rate for 80% of home sales in our state (those for $500K or less). Another 18% will see no change at all (sales above $500K but less than $1.5 million). Only those whose homes sell for $1.5 million and above would see an increase in the rate (to 2.0%) – and only on the portion above $1.5 million. There is an additional rate bump to 3.0% if a home sells for more than $7 million – on the portion above $7 million only.

Questions about these proposals? Contact me.

Behind the scenes in Olympia

Have you ever heard of the House Rules Room in the state capitol? What exactly is a Rules Room, and what happens there? I recently recorded a short video to give constituents a peek behind the scenes at this little-known and rarely-seen room in the Legislative Building. Click above to watch!